Whatsapp Pay is now in India! After two years of speculation and beta testing, the RBI gave the green light to launch last week, right around Diwali. With another UPI app in the picture, which one should you use for your business? We chart out the options for you.

CEO Mark Zuckerberg said in a press note that the launch of WhatsApp Pay in India could change the UPI landscape. Whatsapp Pay is rolled out to over 20 million users in India currently.

There are a number of UPI apps in India today that are immensely popular. According to the Hindu Business Line, about one-third of all the transactions ever made via UPI has been done post the COVID-19 lockdown!

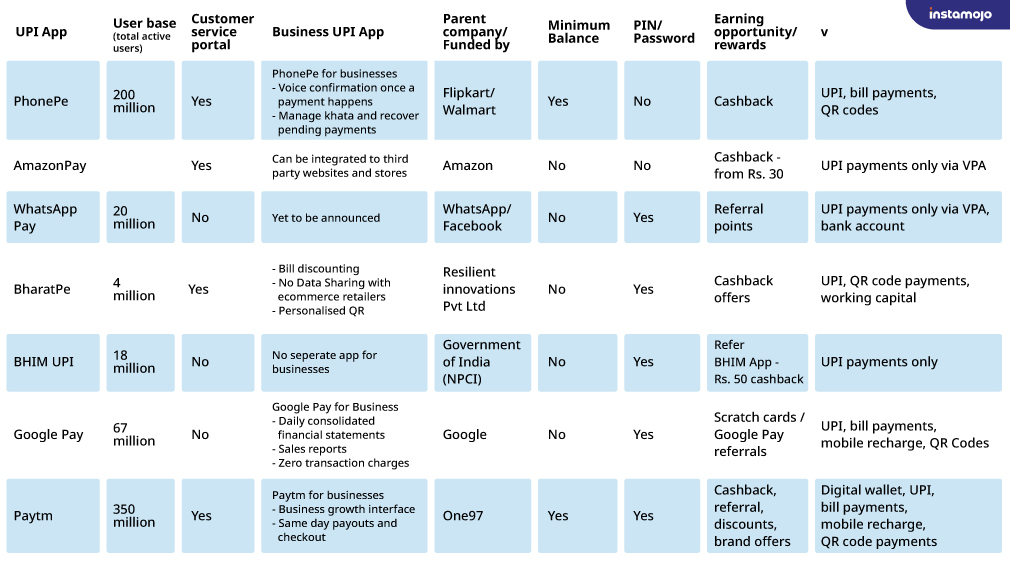

As more people adopt this payment method, it’s important for businesses to understand and offer the right UPI method to customers. Check out this short comparative guide to all the UPI apps you can use for your business.

Top 5 UPI apps in India right now

Here are the top 5 UPI apps trending in India –

- Google Pay

- BHIM UPI

- PhonePe

- BharatPe

- Paytm

- AmazonPay

- Bank apps – ICICI, HDFC

Read – UPI apps you need for Instant Payments

GooglePay, PhonePe and Paytm

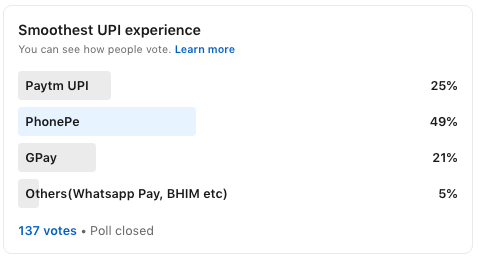

According to a study by entrackr, PhonePe, Google Pay, and Paytm control over 90% market share in the UPI apps segment and PhonePe is leading the show, followed by Google Pay.

Paytm has shifted focus from pure P2P transactions to P2M transactions in the past year. The most popular UPI app for P2M transactions are Paytm and PhonePe.

In a recent poll conducted by our team, it was shown that PhonePe is the preferred mode of UPI payments for small businesses in India.

The rise of BharatPe

BharatPe, a relatively new UPI app in the market, is already becoming a favourite with small merchants. The UPI app relies on QR codes, allows merchants to track payments from customers, and offers working capital assistance to small businesses.

The fall of BHIM UPI

Due to the rise of GooglePay and Phonepe, along with other third-party apps, transactions on the simple user interface BHIM UPI has been steadily falling. Bank apps and privately owned apps too have taken over the original UPI app.

Which UPI is best and safe?

In the below comparison, we have put together points that can help you decide which one to use for your business.

UPI trends for small businesses

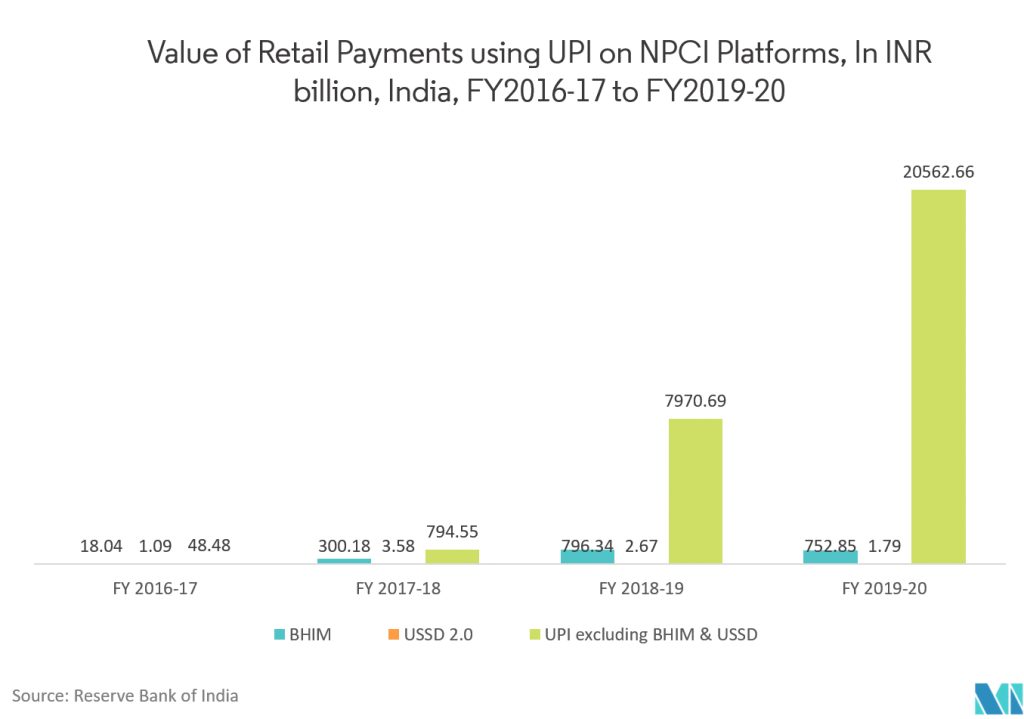

UPI is India’s biggest fintech success since its launch 4 years ago. COVID saw a sudden surge in UPI app usage too, with over 2.07 billion transactions taking place, worth over Rs. 3.86 lakh crore as of October.

What led to the uptick in UPI payments?

- Online shopping

- Festive season sales

- The gradual recovery of the consumer economy

WhatsApp Pay will cater to over 20 million users in the initial phase of its launch. UPI will be exported to global markets including Singapore, Myanmar and UAE. From January 2021, NPCI will impose a cap on UPI third-party applications to process a maximum of 30% of the transaction volumes starting Jan. 1, 2021.

With WhatsApp Pay’s launch, the number of UPI transactions are only set to increase. What UPI trends can small businesses expect?

- The rise in e-commerce UPI payments. RBI projected UPI transactions for the coming months to rise by 180%, especially with offline retail sectors collecting money via QR codes, phone numbers and UPI VPA.

- Increased protection of customer funds with the automated real-time dispute. NPCI is conducting talks with brands and payment companies to roll out a real-time dispute resolution system for failed transactions on all UPI apps. This way customers do not have to manually raise tickets with the backend.

- Enabling tax payments through UPI for increased security, reduced fraud.

- Increase in UPI transaction in tier2, tier 3 cities.

- Rise in mobile payments towards the end of 2020-2021.

Why UPI is not enough for small businesses

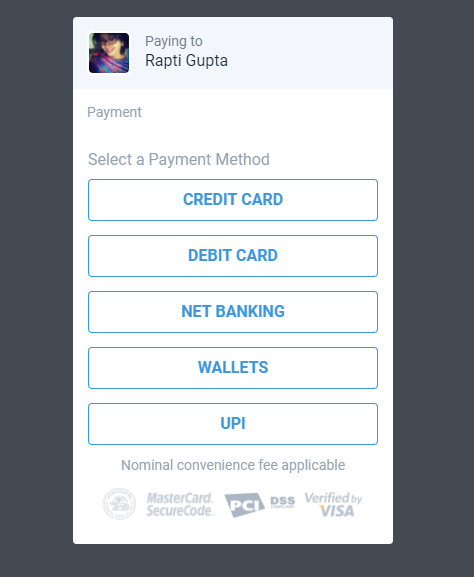

Reason #1- Simply because small businesses need to offer flexibility to customers to pay with whatever modes they choose. UPI is definitely one of the most popular and adopted payment methods in India but cash, cards, and bank transfers still are the first choice of payment for Indian customers.

Reason #2 – As a small business grows into large ticket size transactions, UPI may not be the best option to receive payments as current limits stand at ₹1 Lakh a day per VPA. International payments are also unavailable with UPI at the moment.

Reason #3 – UPI does not offer complete merchant-based solutions (although the NPCI is working on building features for businesses in UPI 3.0). Small businesses need integrated solutions – a one-stop-shop for payments, online selling, shipping, and marketing.

That’s why Instamojo offers everything a small business in India needs to grow online.

For starters, Instamojo supports all modes of payments and all modes of UPI! Customers can pay online using net banking, credit/debit cards, and wallets too.

Instamojo payment and product links on WhatsApp

Speaking of different payment modes, could WhatsApp Pay overtake all the above UPI payment modes? Perhaps. But did you know WhatsApp Pay is not the only way to make money via the app? You can also send payment links and product links to your customers via WhatsApp with Instamojo.