UPI is a blockbuster payment mode. Its interoperability and ease-of-use made it a mass favorite. With this massive growth, what are small businesses expectations from UPI in the future?

Small businesses have adopted UPI (Unified Payments Interface) a lot faster than other modes of payments. There were 30 million UPI transactions just within a year of its launch!

What are small businesses expectations from UPI 3.0?

As more businesses favour UPI payments, we take a look at small businesses expectations from UPI in the future.

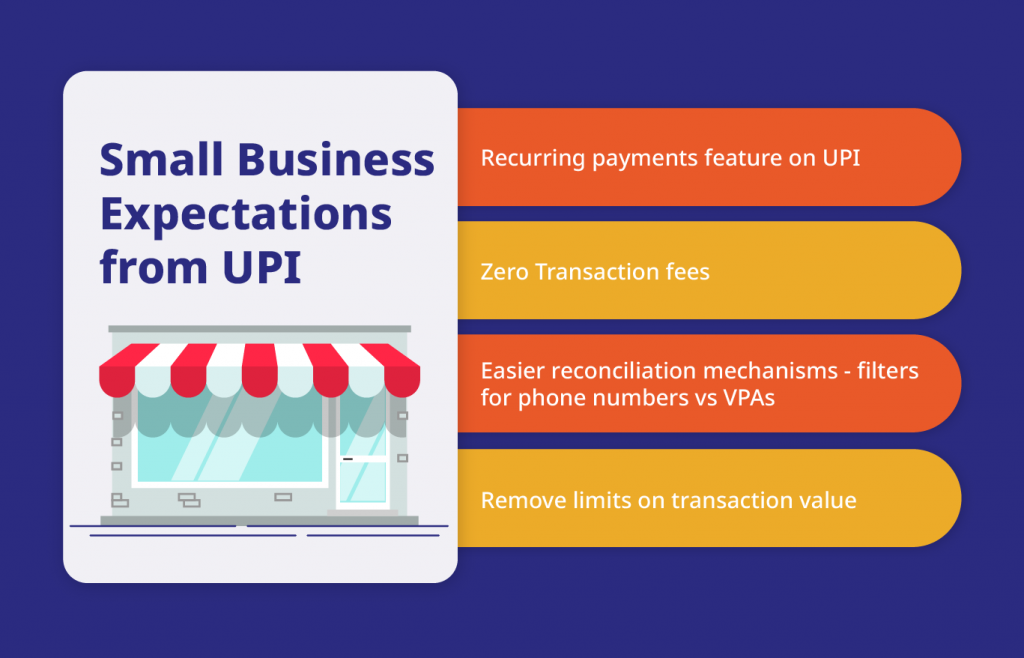

Small Business Expectations from UPI – 1: Recurring Payments:

Think of this as an extension of the one-time mandate feature introduced by UPI 2.0. Not unlike Credit Cards, businesses expect UPI to have a one-time authorisation mechanism that could deduct money from customer’s bank account at regular periods (best suited for a subscription model – Netflix, HotStar, Amazon Prime, etc).

Small Business Expectations from UPI – 2: Remove Transaction Limits:

In June this year, NPCI launched a new UPI category – P2PM. Any small businesses on-boarded in this category is allowed free transactions up to Rs.50,000. This was a move to promote small merchants who are yet to join any digital payments platform.

For future transactions, small business merchants expect a lift/broadening of the transaction cap. For businesses that transact in large volumes, the limit could pose a challenge.

Small Business Expectations from UPI – 3: Zero Transaction Fees:

For merchants, The NPCI charges a small fee of 25 paise for transactions up to ₹1,000. It charges 50 paise for anything beyond that. While this does not affect small merchant transactions yet, small businesses will be quick to withdraw from the app if the transaction fees continue.

Banks are now starting to levy UPI transaction charges on buyers/customers post 30 transactions. This could slow down the growth of UPI payments, indirectly affecting merchants.

Small Business Expectations from UPI – 4: Filters for Easier Reconciliation:

While one of the best features of UPI is its interoperability, it could make reconciling books of accounts slightly difficult for small merchants. A filter for the source of payment, VPA, or phone number could simplify accounting for merchants and clarify the source or purpose of the payment.

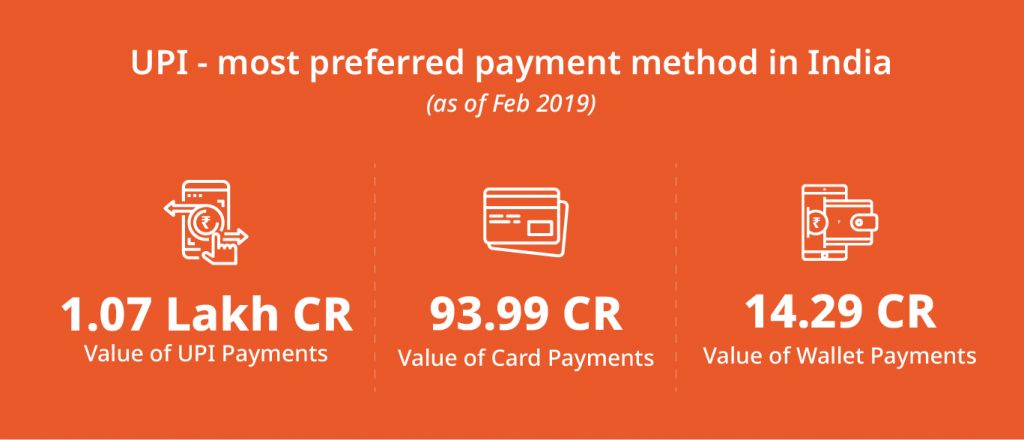

UPI vs. Credit Cards – How UPI is taking over Card Payments

Labelled the ‘Digital Wallet killer,’ UPI may soon take over card payments for businesses as well.

How? Credit card usage and wallets share have been considerably declining over the last few quarters. If expectations are met, UPI may become the preferred real-time mobile payment platform of the country.

While people are already using UPI for P2P payments and bill payments, they are also using UPI for loan repayment.

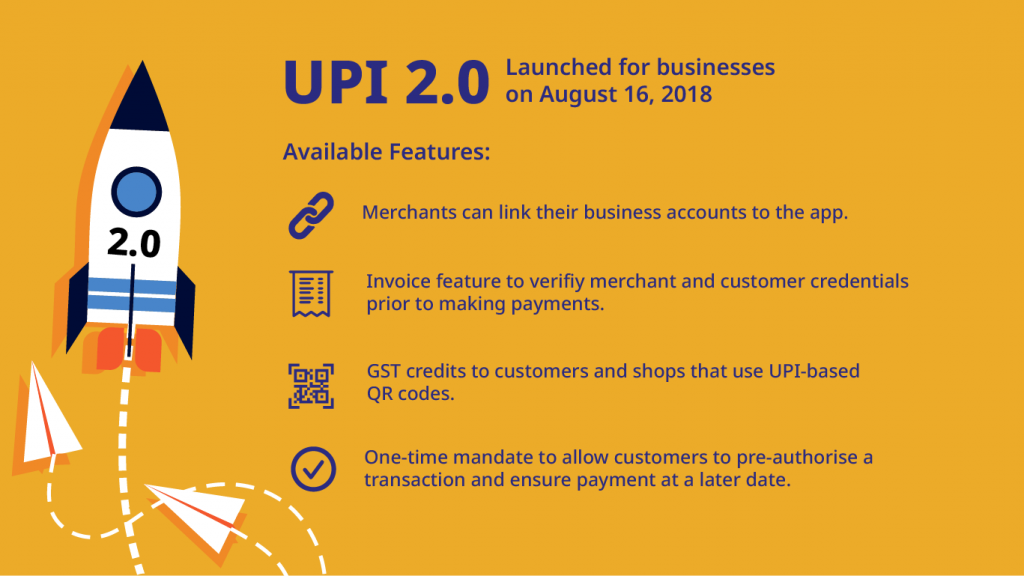

UPI 2.0: Features built for businesses

The NPCI launched UPI 2.0 on August 16, 2018. Up until then, UPI was largely a person-to-person payment mode and lacked features that could support businesses. There were a host of new UPI features introduced for businesses.

How small businesses collect payments using Instamojo UPI

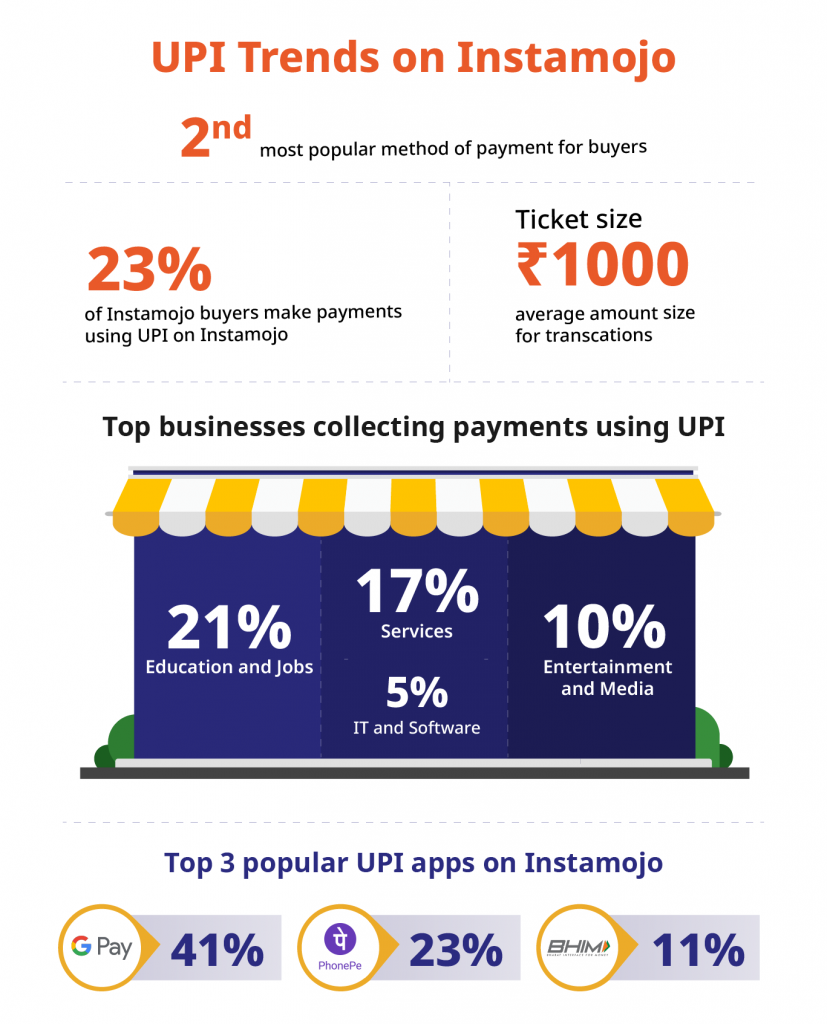

As a payment gateway aggregator for small businesses, Instamojo allows businesses to collect payments with multiple UPI modes – including Google Pay and Paytm UPI! With Instamojo UPI, a merchant doesn’t even need to create a new Virtual Payment Address (VPA).

UPI is the most preferred form of collecting payments for Instamojo merchants. This is primarily due to the ticket size of the transactions, as UPI is most often used to make transactions in small amounts.

At Instamojo, We support various UPI modes. You can even add UPI payments to website or app in under two minutes. Simply create your Instamojo account, and start collecting payments.