The RBI has issued a new rule that does not allow digital wallets and e-commerce payment system operators to use exclusive QR codes that can be accessed only via their platform.

Interoperable QR Code Payments – Only on UPI Apps

Effective March 2022, RBI has notified payment system operators like Paytm and PhonePe to allow customers to pay via QR codes on any platform from UPI- supporting apps only.

Why the new rule?

With this new decision, RBI wants to:

- Reinforce acceptance and digital infrastructure – integrate new financial instruments

- Provide better user convenience with interoperability

- Enhance system efficiency

In other words, the Government is pushing for interoperable QR Code payments to boost UPI as a platform and centralise transactions.

Rules and regulations for new QR codes- who can use it?

UPI has seen a significant spike in transaction volume since last year, and with the pandemic, it’s proven useful to anyone looking to adopt contactless payments.

Also read: How to sell using QR codes – a complete guide

The move by RBI benefits both businesses and customers alike. Here’s how –

Proprietary QR Codes Vs Interoperable QR Codes –

No proprietary QR Code (unique QR code) will be allowed by payment systems. This will help the customer maintain payments done via QR code in one place. A unique QR code will force both customers and sellers to maintain different apps if they have to make a purchase from different retailers since the merchants might use different proprietary QR codes depending on the payment operator they tied up with.

One Place for All Transactions

Most QR Codes printed on stores which customers use to scan are ‘static QR codes’. With these, sellers do not have any other information when a customer pays them an amount, which will make it harder for them to track payments.

Better customer experience in the long run

The move for interoperable QR codes will also help businesses to differentiate on the experience they wish to provide customers. With the new norm, customers can pay businesses via their UPI app – and not just a specific app.

QR Code payments in India – the new contactless payments you should use

QR codes are one of the most low-cost modes of online payment for small businesses. Since COVID struck, QR codes are on the rise as one of the most popular versions of contactless payments. So far, China is in the lead with QR code payments.

A report by MediaNama showed that a total of 20 million UPI QR codes have been deployed in the market with around 250 million transactions taking place every month through these QR codes!

Contactless payments on Instamojo – top 3 payment modes like QR codes

QR code payments made a wave during COVID, and with new norms coming in, small businesses might wonder if there are other payment modes that can be made available to customers. Fortunately, not all payment systems are in trouble. With Instamojo, you can offer customers 3 unique contactless payment options – in just a few steps.

Request a Payment/Bulk Payments

Why send payment links one by one when you can request payments in bulk from your customers? You can request a one-time payment from your customer with the ‘Request a Payment’ option on the Instamojo dashboard or send bulk payment requests for huge orders too. You can request payments for a subscription model, freelance projects or rentals.

Read: Find out how graphic illustrator Annada Menon manages bulk orders on Instamojo

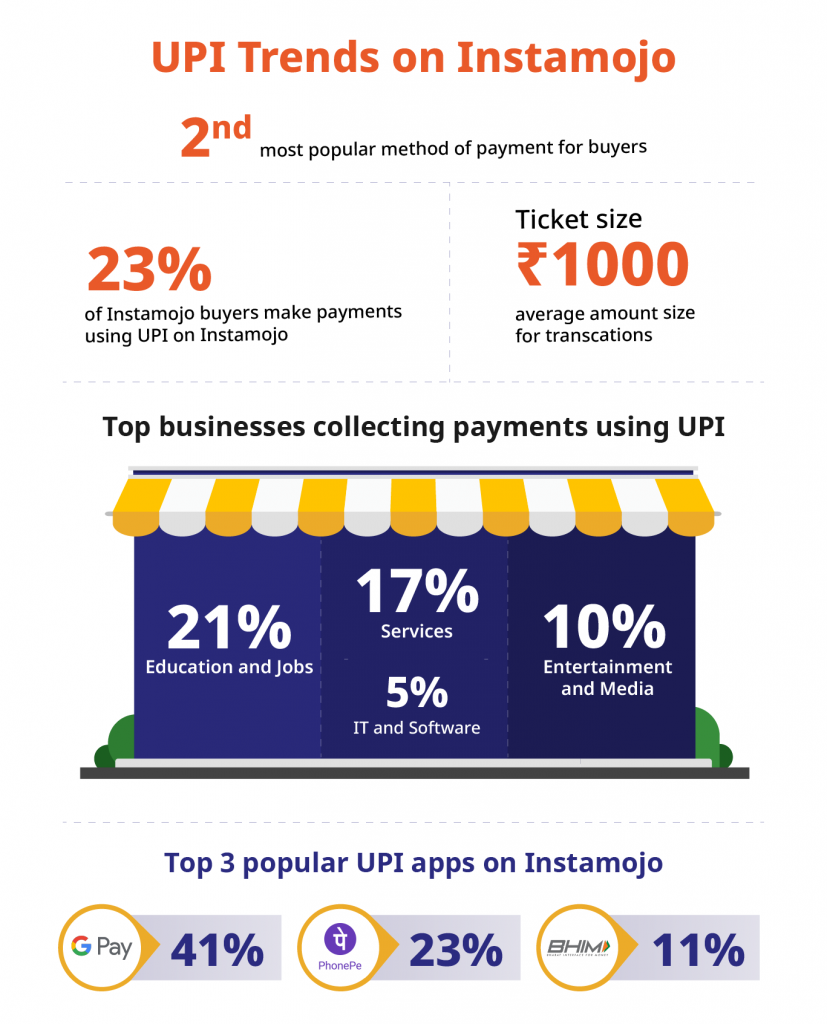

UPI – Unified Payments Interface

Since QR codes are payable via UPI apps, youare in luck Instamojo supports BharatQR and UPI payment modes for all types of transactions.

Netbanking

Customers can also pay you online via net banking. India will cross around 150 million users for net banking services by the end of this financial year. On Instamojo too, there are over 60 banks that customers can access when making online payments.

EXPLORE INSTAMOJO’S PAYMENT OPTIONS

1 comment

Superfast payment service is the future of India and other countries too. Almost everyone want that fast and secure payment environment.