On Thursday, Finance Minister Nirmala Sithraman announced that businesses affected by COVID will get a 2% interest subvention on loans up to ₹50,000, under the Mudra Loans Shishu Scheme.

The Finance Minister provided the interest subvention for up to 12 months, with a relief amount of up to ₹1500 crores.

Currently, Shishu loans have a repository of ₹1.62 Lakh crore.

If you are looking to apply for the MUDRA loan, here’s what you need to know.

How to apply for MUDRA Loans Scheme

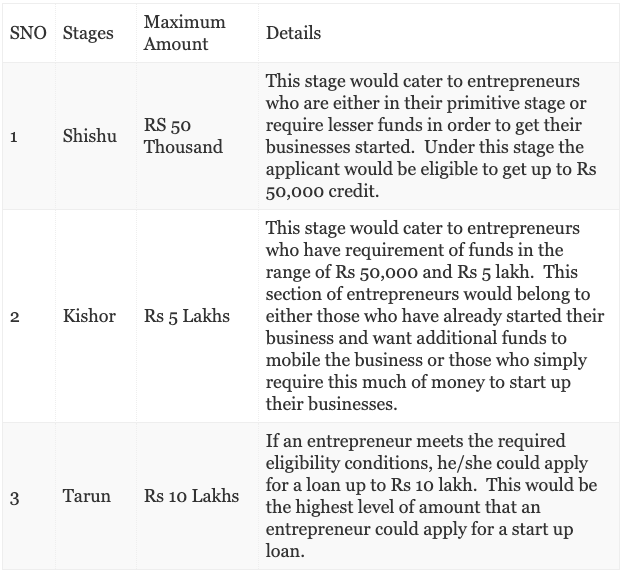

Launched in 2015, MUDRA loans (Micro Units Development and Refinance Agency) are loans offered under the Pradhan Mantri Mudra Yojana. Take a look at the Mudra Loan Scheme features in this table below:

- To apply for the MUDRA loan, all you need to do is download Shishu, Tarun and Kishor forms.

- It helps to have a current account with the bank where you apply to. Ensure your credit history is good.

- Carry invoices for any equipment if any.

- Before approaching the bank, keep all documents ready.

Documents required for MUDRA Loan:

- Identity Proof – Driving License, PAN Card, Passport, Aadhar Card

- Proof of Residence – Telephone bill, recent electricity bill

- Passport Size photos -2

- ID Proof and residence proof of business – if your business has an offline store, provide the residence proof. If not, ensure you have the business license and registration certificate.

- Clearance Certificate from the pollution control board

- SSI Registration from the Ministry of MSMEs.

- Balance sheets for up to 3 years ( for loans above₹ 2 Lakh) – bow audited and projected Balance sheets for the next 3 years.

For further document details referring to a specific loan, check here.

Types of MUDRA Loans your business can avail:

- Working Capital Loan

- Overdraft Facility

- Business renovation loan

- Machinery and plant loan

- Agriculture loans

Related: Top 5 Government Schemes for Farmers

MSME Expectations From the Ministry

On Wednesday last week, Finance Minister Nirmala Sitharaman announced a slew of measures for the MSME sector, along with an economic relief package of over Rs. 20 Lakh crore to help businesses affected by the COVID. However, the MSME sector has a few expectations, mostly smaller measures to help them sustain.

- The 2% interest subvention has MSMEs – This scheme could negatively affect Micro units struggling to pay even the reduced interest over the next 12 months. The demand and supply imbalance is sure to impact these businesses. The SMEs were hoping the Government could have reduced it a further 4% to help them financially.

- Increased moratorium on loans till the next financial year.

- The Government’s recent announcement to remove fresh insolvency proceedings for a year also has MSMEs upset. MSMEs are looking to start businesses from scratch, and they want announcements on tax benefits, faster online refunds, self-declaration etc.

Instamojo recommends:

- If your small business is looking to apply for a MUDRA loan, ensure your credit history looks good. Pull out your invoices, balance sheets and maintain a record of everything to attract funding.

- Approach the Champions website by the Government to keep up with the MSME sector and address grievances.

- Join the new MSME ideas portal to attract VC funding for your business.

- Take this time to understand more about your business. Apply for an online course on GST or Accounting and learn how to improve business operability.

- Pay employees their wages, and reduce production till you receive the stimulus package.

The MSME sector is looking for quicker solutions, and one of them is to explore online tech platforms to sell their products. The Agricultural sector is already turning to afire-tech platforms to sell their produce, and so can you. The Instamojo premium online store is the ideal platform for you to sell your products and services during the restricted lockdown.

PRE-BOOK YOUR PREMIUM ONLINE STORE