The faster you receive customers payments in your bank account, the better it is for your business. To help businesses enjoy this privilege, we launched the Instant Payouts feature in your Instamojo dashboard.

With Instant payouts, you can collect your customers’ payments in minutes!

What is the process of online payment collection?

Most businesses which fall under the Micro, Small and Medium Enterprises (MSME) sector do not have adequate access to capital to finance all their business requirements. Many businesses, which currently still maintain an offline presence, deter from moving into the digital space for a number of reasons.

Payments take 3 business days to reach sellers account. This is also referred to as ‘T+3’ settlements. The rules and regulations set by Government and banking partners require payment companies to settle payments in 3 business days. However, this may pose a challenge to some small businesses that need payouts quicker.

Why Instant Payouts?

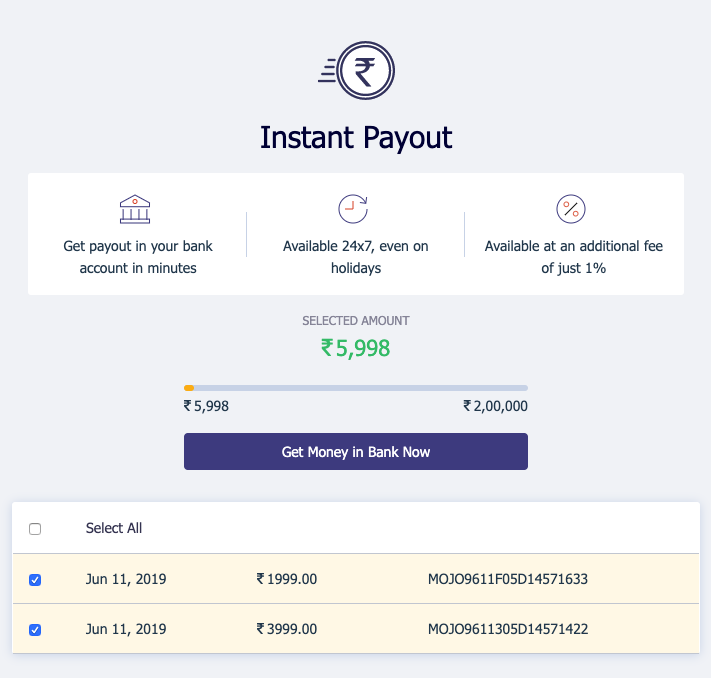

Instant Payouts helps businesses transact the payments received on Instamojo within minutes. Just select the payments you have received and get the money in your bank account.

The prime feature of this top-performing product is to always provide businesses with a seamless experience to get payments instantly. You can get Instant Payouts of up to INR 2,00,000*.

Why are Instant Payouts important to a business?

- Account for unexpected expenses: When you run a business, you need to take care of expenses that might come in at the last minute. Therefore, with Instant Payouts, you can manage these expenses easily once the customer makes a payment. The money is immediately credited to your bank account and you don’t face a shortage of funds.

- Pay vendors on time: Simple, your receive money quickly, you pay your vendors quickly. This helps you maintain a strong relationship with your vendors and builds trust for any future transactions.

- Healthy cash flow for business: Maintaining a steady cash flow for your small business is important to run daily operations with ease. Instant payouts get you your money in real time and take care of your working capital requirements.

- Customer order fulfilment: Once you get your money from customers, it speeds up the process to fulfil the order process for your customer. From placing the order with the warehouse to shipping and delivery, the process for a customer to receive their product becomes more seamless.

An example of Instant Payout:

A customer makes a payment to purchase a book from a publisher on Instamojo. Default payment methods require the user to receive the payments in 3 business days from the date of transaction. Instant payouts help to get this payment settled instantly.

How can you avail Instant payouts?

- Use the Instamojo payment platform to get your customers to make the payment. You can receive payments through Payment links, Smart Links or via the online store.

- Login to your Instamojo account.

- Head to Instant Payouts section

4. Select Payments and click on ‘Get Money in Bank Now’

First, we introduced Next Day Payouts, followed by the Same Day Payouts feature in your dashboard. We one-upped with the Instant Payouts feature too. What’s next?

Create your Instamojo account now and start collecting payments quickly, easily and fast!

*You can receive payments up to INR 10 Lakh. Instant payouts can be availed by all KYC-compliant merchants.

COLLECT PAYMENTS USING INSTANT PAYOUTS

3 comments

thanks for sharing this information

how we can transfer our amount directly to our bank account but ??

you can manage these expenses easily once the customer makes a payment.