Last year was a remarkable period for team Instamojo. It came, it went, it conquered quick.

In this note, I shall try to encapsulate our journey including our product & financial progress. Also, for the first time, we are going to give a few forward-looking statements.

The first half of FY18 was the toughest for team Instamojo. If not for an internal cost rationalization, while pushing the pedal for growth, we could very well have shut down.

We were face-to-face with failure but the Instamojo family came together to keep the company afloat. We decided we weren’t going down without a fight so we cut back on expenses, hustled harder and set rigorous goals for ourselves.

While the internal cost rationalization helped us keep the engines running, we needed to find some sort of cash infusion. Just about a couple months later, I met with the team of AnyPay, a Japanese payments firm that wanted to explore the Indian MSME segment.

We raised our pre series-B funding from AnyPay, Beenext, Dream Incubator Japan & few others and since then, there has been no turning back. So far, we have raised $7Mn in total.

We are now well capitalized for the next 18-24 months for our core payments business. Any additional capital we raise in the near future will be for our VAS (value-added services) play. (More on that later).

We built Instamojo based on few fundamental theses for India and MSMEs. Today, I’d like to speak about them:

- All MSMEs will go online – One of the core thesis, when we started 5 years back, was that MSMEs of all shapes & sizes, irrespective of their location will go online and adopt digital solutions to sell, manage & grow their business. It’s a matter of time.

- Variable costs driven solutions – Only those digital solutions which allow MSMEs to scale their business at variable costs will get adopted faster.

- Digital payments is the 1st step towards bringing 60 million MSMEs online and create millions of digital entrepreneurs. Why? In a heterogeneous market with information asymmetry and supply constraint, following first-principle problems is the most optimal solution for long-term impact. And money collection is a first principle problem.

We set out to disrupt the payments industry with shareable “payment links” and e-commerce with a “forever free online store,” which requires only a bank account & phone number to use. Why?

Because getting the best payment gateway was not only expensive but also technically complex for the vast majority of MSMEs. The ever-changing compliance policies and the technological nitty-gritty made it all the more inaccessible.

Now, as we paint the larger canvas, let’s talk about what we achieved so far in FY18:

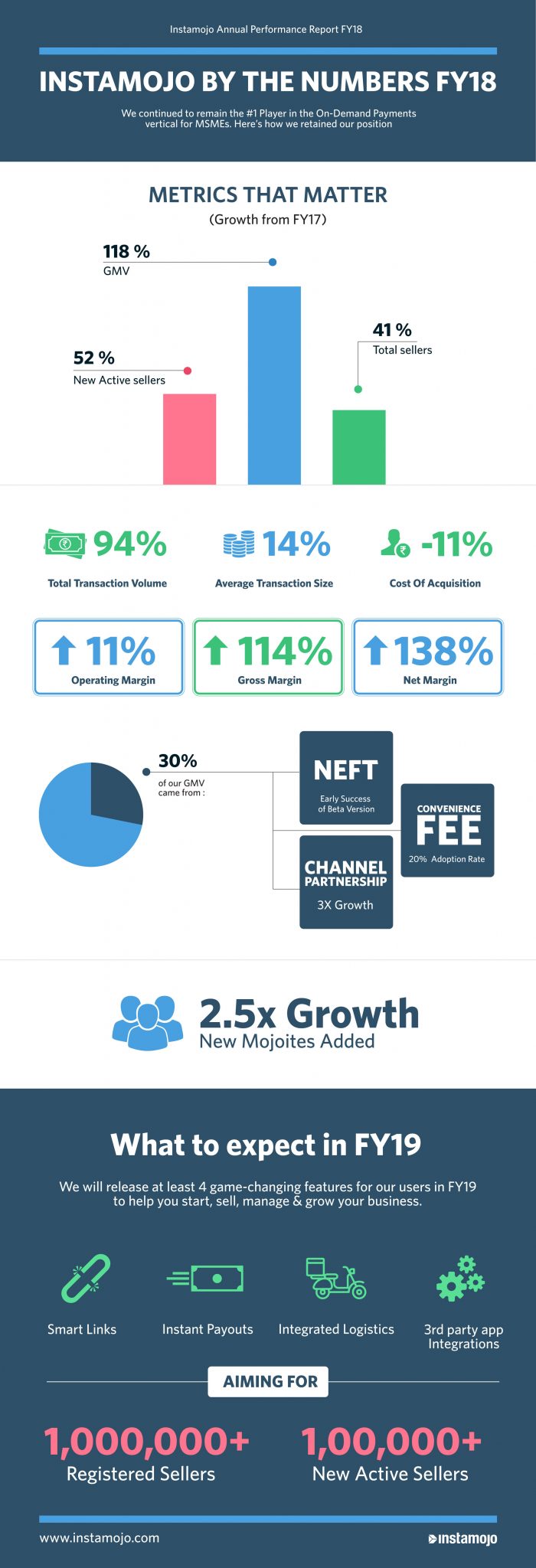

- Our core metrics like GMV, total seller addition, and net new active seller addition have grown by 118%, 41%, and 52% respectively vs FY17.

- Our operating margin, gross margin and net margin have increased by 11%, 114%, and 138% respectively vs FY17.

- Our total transactions volume and average transaction size have increased by 94% and 14% respectively vs FY17.

- CAC (customer acquisition costs) has fallen by 11% on a blended basis. We expect this to fall further as we scale.

- With increased scale, we have added new Mojoites by 2.5x from FY17. We are now almost 100 members strong.

- On a monthly net basis, we have amortized our S&M (sales & marketing) and G&A (general & administrative) expenses. Our next target is R&D (employee costs) while keeping ourselves gross profitable all this while.

- In FY18, we added over 30% of total GMV by new product launches like channel partnership program & convenience fee model by continuously listening to our users.

- We used machine learning in many areas like assisted support & inside sales which allowed us to focus on driving efficiency which reflects in the above metrics.

- We won the “Best Payment Technology / Solution Provider in 2017” by India’s Internet & Mobile industry’s governing body – IAMAI amongst many other awards.

Also, for the 1st time, we want to give few forward-looking statements and few market-facing product launch promises:

- In FY19, Instamojo will transition from “just payments” to a “one-stop transactions platform” with the launch of VAS (value-added services) starting Q2FY19.

- We will launch a single integrated dashboard across mobile & desktop to start, manage & run your business.

- We will surpass a GMV run-rate of Rs 6,000 Crores.

- We aim to become the 1st online transactions platform to surpass 1 million seller base.

- We want to add 100k new active sellers to become India’s largest online transactions platform.

- We will release at least 4 game-changing products in FY19, namely Smart Links (payments), Instant Payouts (credit & lending), Integrated logistics services (shipping & delivery) & 3rd party apps integration (taxes, emails, invoices etc.).

- Last but not least, I am truly grateful for having a team that believes in collaboration, learning and hustling to make business easier for anybody that wants to become a digital entrepreneur.

While we have come a long way, we have a longer way to go. And we at Instamojo, promise you to deliver “Simpler, Faster & Affordable” transaction experiences in coming times.

Until next time.