Our mission at Instamojo is to empower MSMEs become truly enterprising and participate in the digital economy to grow their business. And as the new financial year begins (FY20), it is truly a great time to look back at what we’ve achieved in the last 12 months (Fy19). We are calling our annual performance report the Annual Impact Report because we have touched MSMEs in the smallest nooks and corners of India with our Value Added Services (VAS) and new product additions.

In the next few paragraphs, I want to take the opportunity to run you through Instamojo’s financials and numbers and emphasize on the goals we have for FY20.

We started 2018 with daunting goals in place. We wanted to launch Value Added Services like shipping and working capital loans to bolster our existing transaction products and were able to roll the services out and promote adoption amongst our merchants.

The new product launches didn’t just open up avenues for more revenue but also saw more MSMEs joining our platform. In fact, we have been adding almost a merchant every minute on the platform!

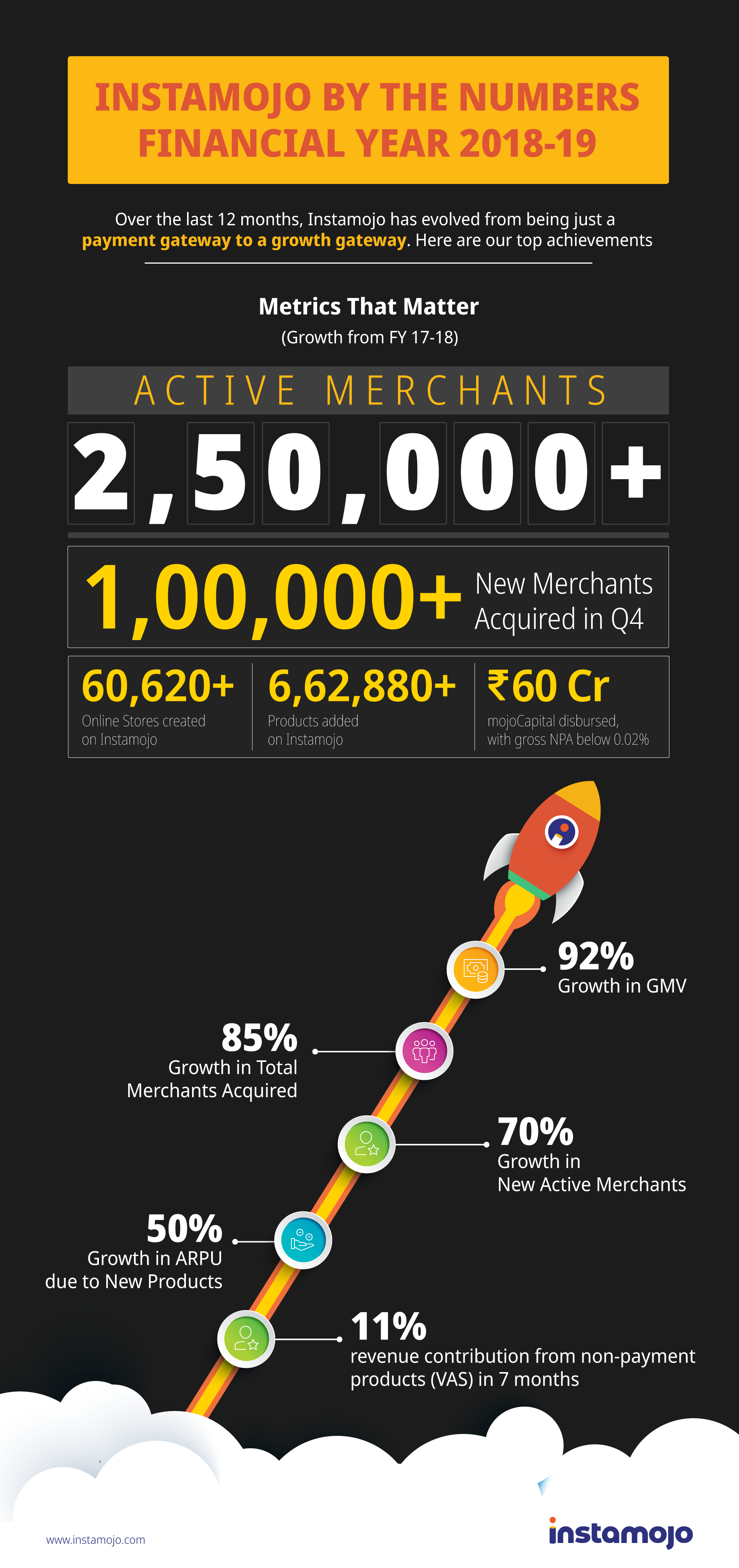

Take a look at the numbers we’ve hit for the FY 2019

1. Our Gross Merchandise Volume (GMV) grew by 92% in the financial year 2019. We crossed 700,000 merchants on the Instamojo platform and in Q4 alone, we added 100,000+ new merchants. Today, we have 250,000+ active merchants on our platform – a new record for Instamojo and the overall industry perhaps!

2. Over 30% of our merchant base is now actively using the platform, which is a huge feat for Instamojo. We are a DIY (do-it-yourself) platform and about 85% of our merchants self-onboard. This reflects the simplicity and intuitive nature of our platform.

3. Our total transaction volume has grown by 78% – a clear indicator of merchant trust and ease-of-use of the platform. What’s more exciting is the average transaction size has grown by 19%. More MSMEs are coming online and growing their business.

4. Our average revenue per user (ARPU) has grown by 50% due to the introduction of new products. So, as merchants use more services, their activity with Instamojo platform increases, reinforcing our recurring transaction revenue model.

5. Our Cost of Acquisition (CAC) has been stabilizing over the year. The net pay-back period has also normalised at 90-120 days.

Revenue from Value Added Services (VAS) and new product launches:

Till Aug 2018, 100% of our revenue was coming from mojoPayments. Closing FY19, 11% of the revenue is coming from non-payment products and services. This is a turning point for Instamojo.

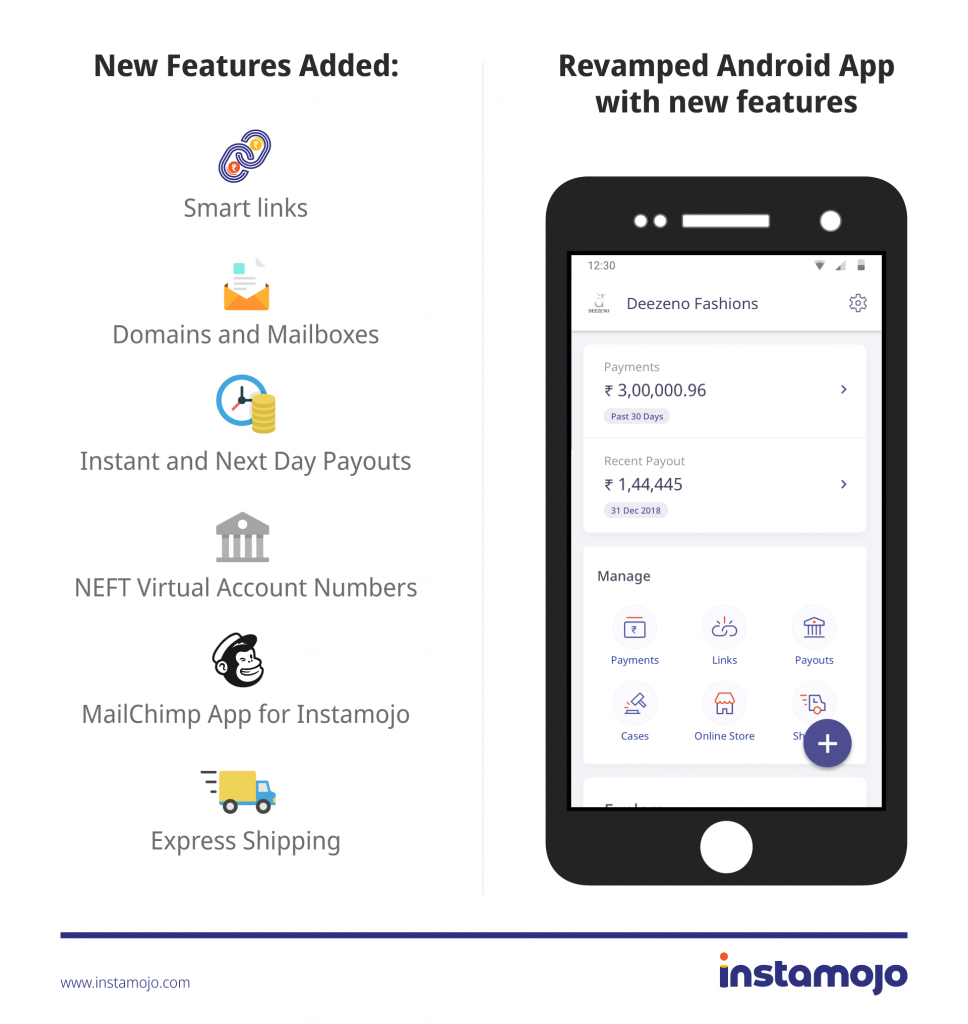

We launched 3 new Value Added Services (VAS) in September 2018 and some new product features that drove revenue growth for us in the financial year 2019.

mojoCommerce & mojoXpress:

- We didn’t just give out the online store a nice revamp but also added a shipping/logistics feature that drove 8% of our total revenue.

- Overall, we have more than 60,620 online stores on Instamojo that have over 6,62, 880 products hosted.

- We have started touching thousands of shipments per month with mojoXpress and we believe this is a big new beginning for us!

mojoPayments:

Payments, our core offering saw a wonderful evolution in FY2019. The team undertook some great product research to build a smarter, better, more functional version of our flagship product payment links. Smart Links truly took off from day one.

mojoCapital:

We launched mojoCapital with sachet loans or working capital loans for small businesses. As of H2FY19, we have disbursed 60+ CR worth of loans with a gross NPA of under 0.02% (2 bps). We were able to build a sleek lending product due to the use of machine learning – these didn’t just help us build better risk/forecast mechanisms but also simplified on-boarding and helped us personalize the platform for our merchants.

We also added many powerful features that aim at solving crucial problems for MSMEs.

The Domains and Mailboxes app was launched to help businesses take their 1st step towards “online presence” and build credibility in the crowded marketplace. We made it available to businesses at 3X cheaper than the market rate. We also launched a FREE app on Instamojo for MailChimp because we believe that MSMEs understand and use email services more than they do other marketing channels.

Content marketing innovation:

We’ve always been trying to innovate in the product but over the last year, we also improvised in the marketing space. Instamojo evolved from being just a payment gateway to a growth gateway, which means giving more power to the entrepreneur in you. We promised we would build to help a business – start, sell, manage, and grow and one of our biggest contributors to that mantra was our content marketing efforts.

1. In the last 12 months, over 500,000 people have visited the Instamojo blog for SME related info.

2. What’s interesting is, 65% of visitors are from non-metro cities like Patna, Kochi, Lucknow etc – this goes on to show that digitization is reaching beyond Indian metros.

3. What’s more? Our fortnightly newsletter called the “SME Wrap” has over 27k subscribers today. This has grown 100% YoY.

Am extremely proud of our baby step bets on creating fresh original content customized & localized to

MSMEs. Look where we have reached: 40k+ MUVs, 65% from non-metros, 25k+ opt-in subs & more. Hope next time you’re thinking online, you won’t visit western sites

pic.twitter.com/1tM7c0yrHA

— sampad swain (@sampad) February 19, 2019

Forward-looking Pointers for FY20:

While FY 2019 will remain a milestone year for us, our ambitions to build valuable products and experiences with value-added services (VAS) will remain unchanged. Just like last year, we have set some lofty goals to achieve for FY 2020.

- Go Big on Mobile:

As 2019 is a year of mobile for MSMEs (micro, small and medium enterprises), we want to focus on our native mobile app which will give easy access to our merchants. We have already started taking baby steps towards it. Today, our eCommerce app has the function to not only create payment links and smart links but also create free online store, ship products directly from the app and even avail sachet loans — all in a click of a button. More magical features are expected to come in 2020.

- Launch Community Platforms for MSMEs

Building a valuable network of entrepreneurs is crucial to the MSME industry. We will be working towards creating platforms and communities to help these businesses connect, learn, cross-sell amongst each other; and thus grow their business.

- Add Value with Value Added Services

We will continue launching Value Added Services (VAS) to make Instamojo’s EPL (e-commerce, payments, lending) stack more powerful, more effective and yet simple to help MSMEs start, sell, manage and grow their business from one destination.

To infinity and beyond.

1 comment