Uploading your KYC documents might seem like a tough task, but it is actually easy, and quite necessary for your business.

Luckily, we have made the process easier for you. In this article, we will guide you through the entire process of submitting/resubmitting your KYC documents.

What is KYC and why you need it?

Know Your Customer (KYC) is a verification process introduced by RBI and controlled by banks to prevent financial fraud from taking place for customers/businesses. By uploading KYC details, helps banks get to know their customers better and help manage risks and protect them from financial crimes like money laundering, identity theft, and terrorist financing.

We need your KYC documents to verify your business and bank accounts to prevent fraud and mitigate risk.

With Instamojo, you can unlock quite a few benefits by updating your KYC details. Some of these include:

- Easily collect over Rs. 10,000 a month as your account limits get removed.

- Unlimited access to mojoXpress, Instamojo’s premier shipping service.

- Use the Faster payouts feature to enjoy Instant payouts, Next Day Payouts or Same Days Payouts.

Besides this, KYC updates help to:

- Identify, locate, and authorize the customer

- Comply with RBI’s Prevention of Money Laundering Act

- Fulfill the bank’s internal risk management

- Monitor transactions for regulatory and tax purposes

How to update KYC on Instamojo

Instamojo requests you to update KYC documents to verify the identity of clients and additionally examining the probabilities of any illegal wrongdoings. Let’s see how you can submit/resubmit KYC details on the website:

First, log in to your dashboard.

You will see a notification bar on the top of your dashboard that asks you to submit KYC to remove transaction limits. Click on the notification.

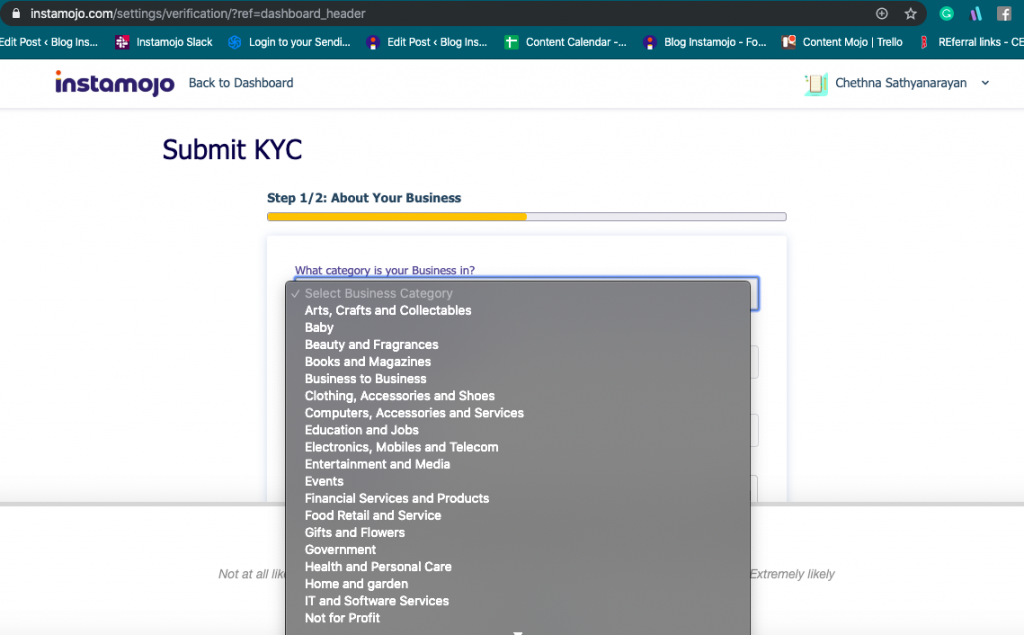

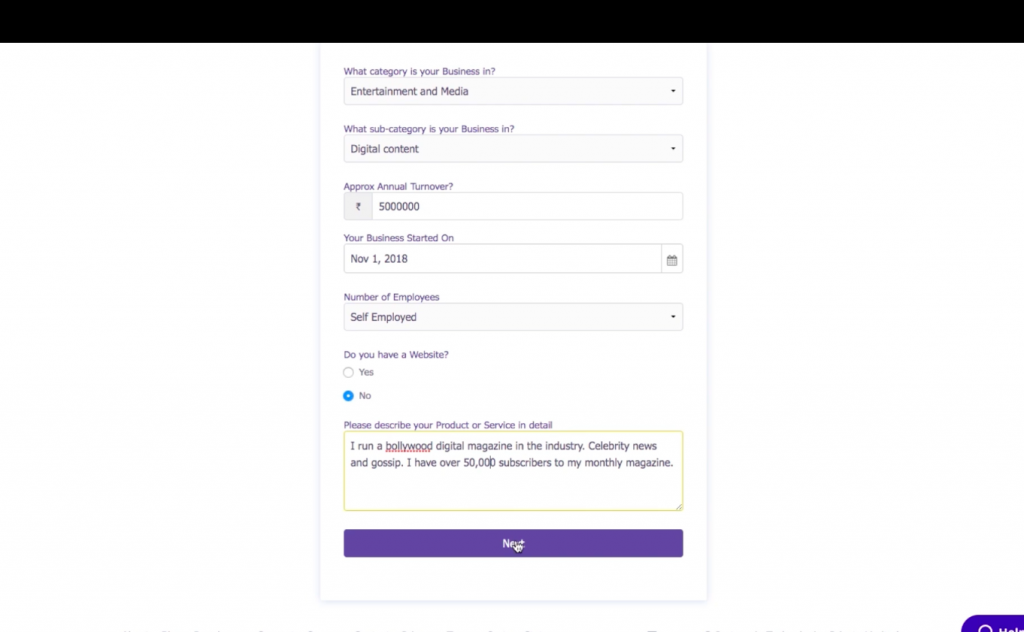

Once you view the steps, start filling in the options. Choose what kind of business you own. After that, enter your business sub-category.

Fill in the other details such as approximate annual turnover, date of start of business, number of employees and a website (if you have one)

In case you do not have a website, click the NO option and describe your business.

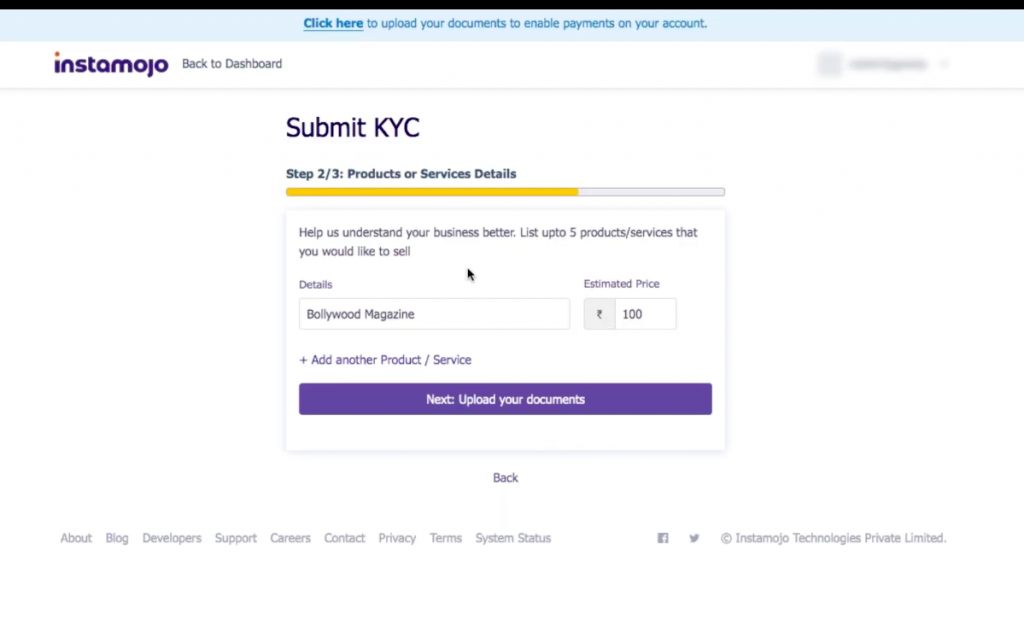

Enter your product and service details – approximately how many products you think you will sell.

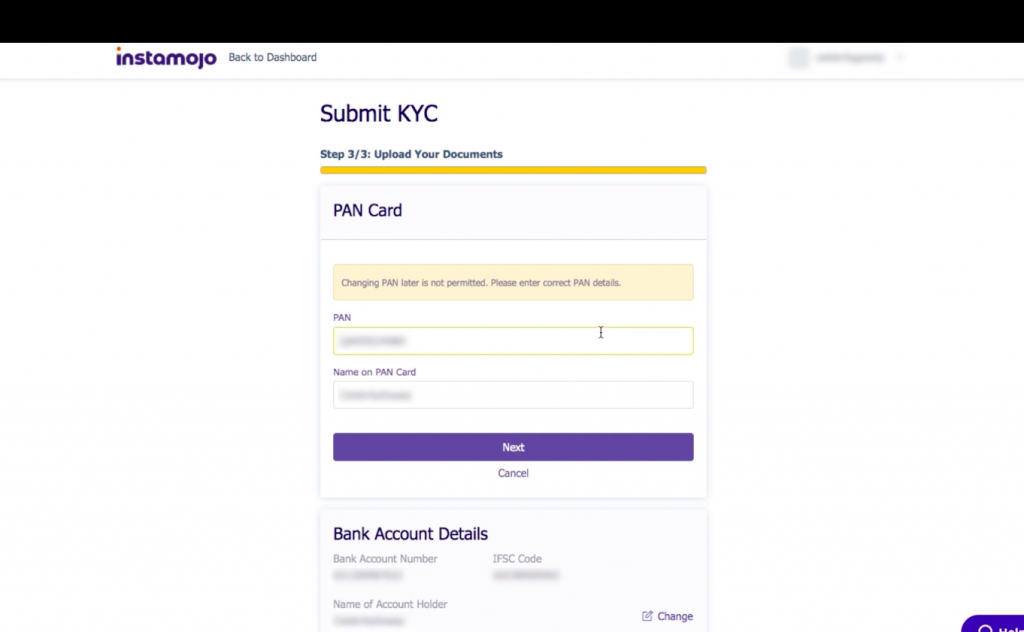

Enter your PAN details. Be careful with this step, as you cannot reverse your action. Upload a scanned copy of your PAN details.

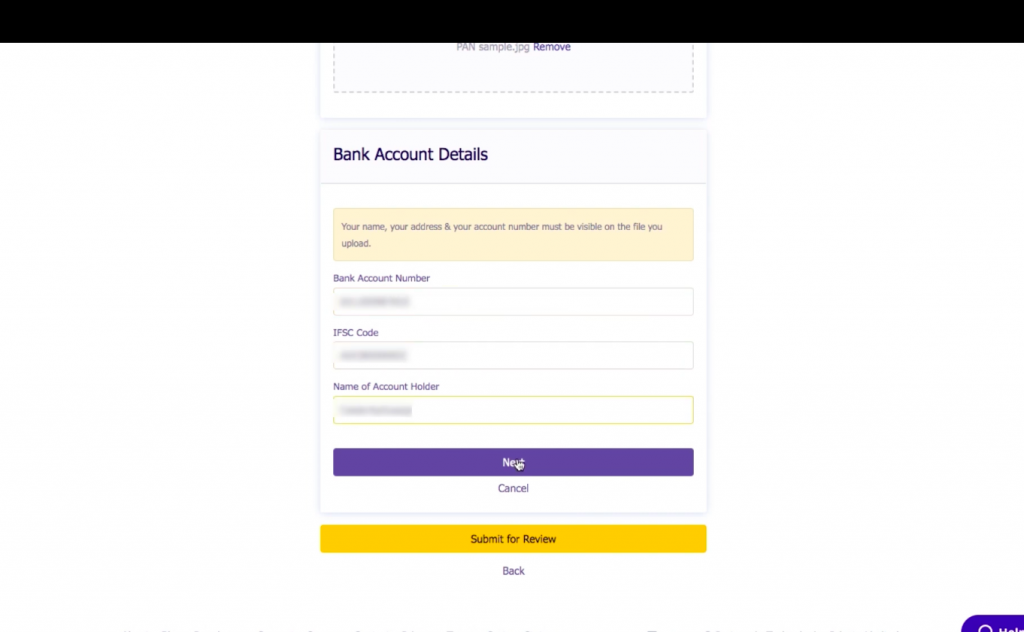

Enter your Bank account details – this is where all your Instamojo payouts will be redirected to.

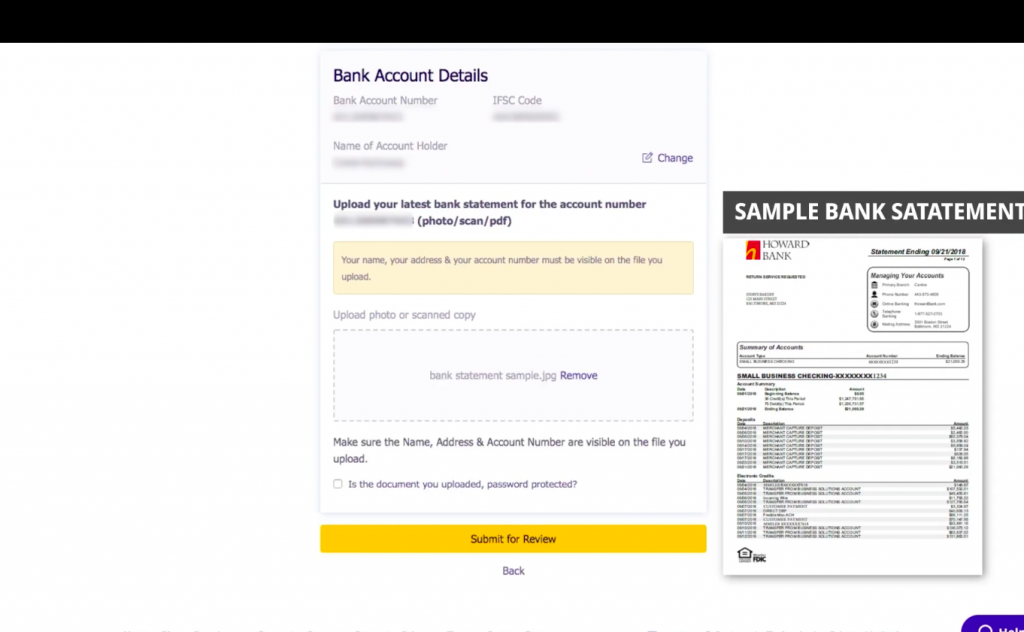

Verify your bank details with a scanned bank statement. Enter your password on the KYC submission page itself.

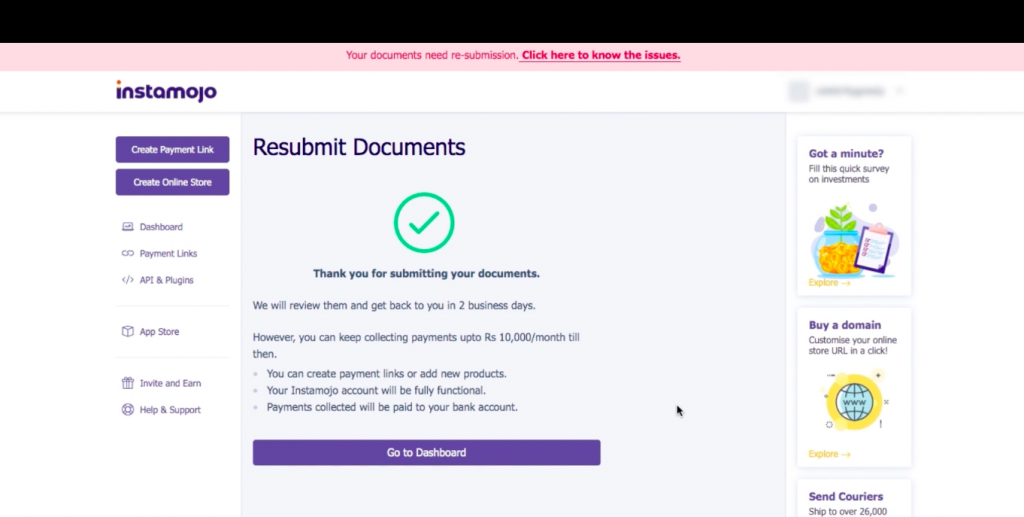

Once you complete these steps, our KYC team will get back to you in the next two business days.

However, what do you do in case the KYC documents get rejected?

Fret not, you can resubmit your documents!

Reason for KYC be rejected?

Usually, your KYC documents could get rejected due to the following reasons:

- Mismatch in your bank account number

- Invalid passwords

- Blurred scanned documents

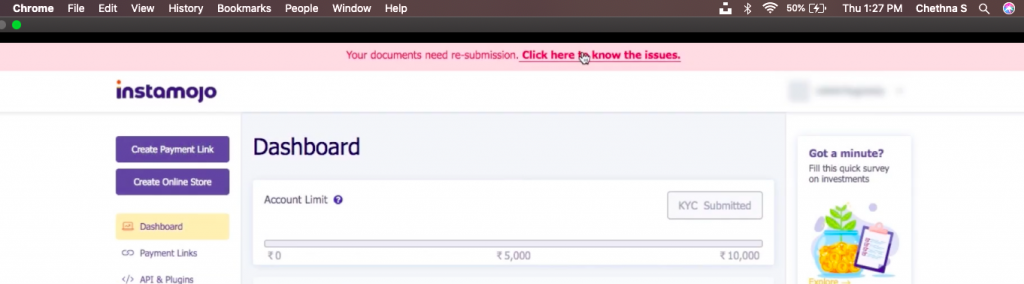

Login to your dashboard and you will see a notification bar on top that allows you to check what led to the rejection of your KYC.

For example: If your account number was not in the bank document, you just need to pay attention to the instructions provided below. Carefully scan your required copies again and resubmit them. The KYC team will never to you in 2 business days.

It’s pretty simple, and of course, if you ever need more help, we have a video tutorial guide to help you out.

1 comment

Hello CHETHNA JEE

When i try to collect payment through Instamojo then its showing “You cannot collect payments through Instamojo. Unfortunately, your business is not compliant with our terms.”

What is the solution please reply