Did your bank reject your business loan application? In an effort to help MSMEs get access to easy credit, the Government of India is launching an app that will let businesses raise complaints when banks deny loans.

What is in an app?

According to the Deccan Herald, this app-based loan financing system will start tracking banks that deny credit to MSMEs. This will not just help the Government check Non-performing Assets but also improve loan availability to small businesses.

Finance Minister Nirmala Sitharaman said if banks deny loans to small businesses without reason, the business can lodge a complaint immediately, using the app.

The loan applicant should send a copy of the complaint to the bank manager as well at a soon-to-be-announced Government centre where the complaints will be processed.

What are the reasons for small business loan rejection:

While credit has increased by over 14% in the last year, stats show that 80% of banks reject small business loans. Banks reject loans for the following reasons:

1. Low credit score:

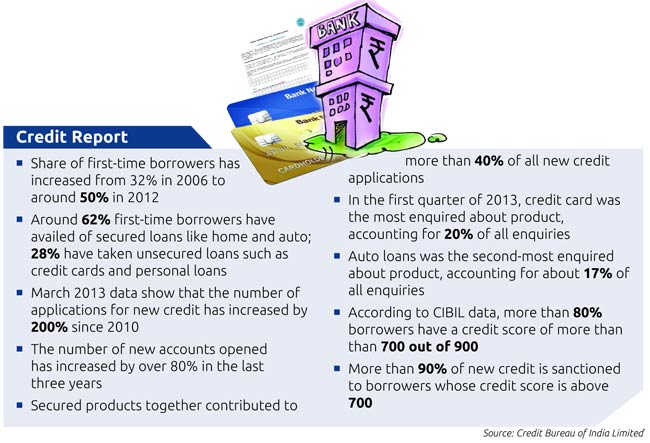

Over 72% of small business owners are still unclear on what a credit score means to their company. In simple terms, a credit score is a number that defines your creditworthiness. It is a three-digit number that allows banks and other non-banking institutions to evaluate how likely you are to repay your debt. Credit scores usually range between 300 and 850.

2. New Business Loan:

Banks are more likely to reject a loan for a brand new business than an established one, due to the risks involved in paying them off. To cap it all, banks do not see new small businesses as profitable options to lend to. Small businesses tend to ask for smaller loans,

Most lenders use a debt-to-income ratio to see if you can handle the payments upon approval of your loan. This helps assess how quickly you will repay your borrowed loans.

Also read: Risk-free Government loans you can apply for

3. Poor cash flow:

Banks check how frequently you pay off your monthly working capital requirements. If your cash flow is in the red, there is a high chance the banks do not trust your business to pay the loan on time. In such cases, make sure your cash flow is positive, and there is enough money in your account to take care of your daily operations.

Your cash flow is positive when the money coming in from sales, accounts receivable is more than the amount you use to pay your vendors, employees and spend money on purchase inventory or raw materials.

Not too sure how to keep a healthy cash flow for your business? Don’t worry, we have a whole guide to help you out!

2 comments

It’s true that most of the time business owners have to face rejection of loans from banks. You can always opt for a Business loan from Lendingkart and avoid rejection due to low credit score or poor cash flow.

Banks’ acceptance rate of loans for small businesses has always been low, but when COVID-19 hits the world, the rate will get more down than ever. It is better to apply for small business loans, where it gets swift approval.