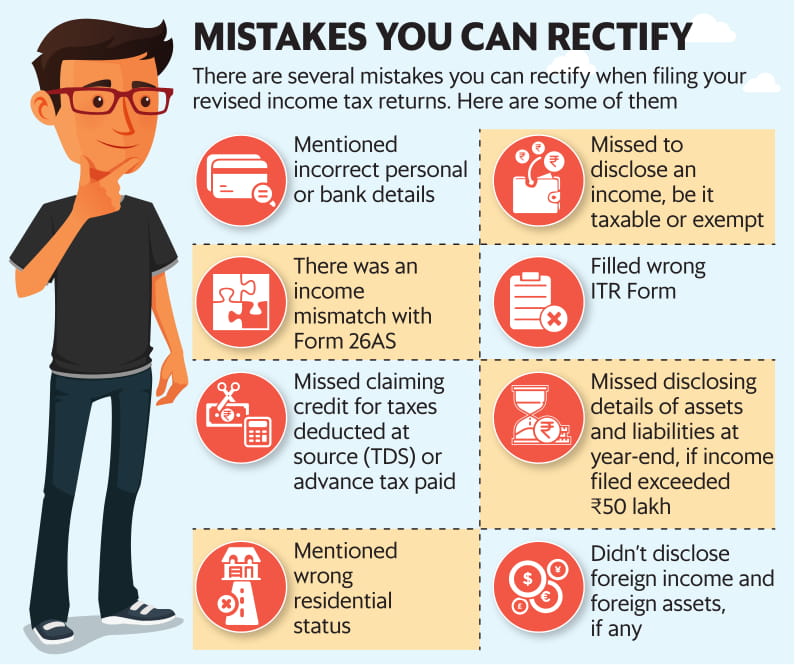

Deadlines can get to even the best of us. Often times, taxpayers miss out on important numbers while filing their tax returns. These errors can range from simple mistakes like incorrectly filling out your address or bank details, to larger issues such as misrepresentations or omission of important data pertaining to income declarations or claims. But, with the provision of revised income tax return, you can rectify your entries to avoid being pulled up by the Income Tax Department for misappropriations.

Ways of correcting your returns:

There are two ways you can revise or correct your returns once filed:

- By submitting a rectification request under Section 154 of the Income Tax Act (or)

- Filing a revised return under Section 139 (5) of the Income Tax Act

Source: LiveMint

Are there any consequences to filing a revised tax return?

You will not suffer any consequences due to multiple revisions. There is no limit to the number of times you can revise your filings, but too many revisions or huge discrepancies in numbers can pull the red flag while your returns are being evaluated. Hence, care must be taken to avoid future hassles.

How to file the revised income tax return?

The filing and verification of the revised forms are similar to the procedures followed in the original filing form. The only changes in the new form are, they will indicate the areas of the proposed change, as compared to the initial form. The revised form should be filed in the same manner as the original tax return form, either electronically or physically.

There is no separate form to file the revised returns. Hence, ensure you select the option which indicates this is a revised filing. Additionally, mention the acknowledgement number of the original form to add a sense of continuity. Keep a copy of the original form, as it will be withdrawn on submission of the revised returns.

When can you file for the revised income tax return?

Previously, one could use this provision only if you filed the returns ahead of the deadline. Now, even belated taxpayers can use this option to revise and correct errors made while filing.

It is important for salaried class taxpayers to review the Form 26AS, before submission, to avoid notices from the Tax Department. The Form 26AS is a tax passbook which documents a consolidated tax credit statement. This entails details such as deposits, taxes deducted on your income at source and more. The primary sources of taxes accounted here are TDS, TCS, self-assessment taxes and advance taxes.

If you are caught for misreporting or underreporting data, you can be fined a penalty of 50% to 200% of the tax amount you tried to evade. Thus, ensure, you cross-check this form, before submission. Here, are some ways small businesses can save on taxes. The most common reason for businesses to misreport tax filings is the general lack of awareness amongst them. Here, are some of the must-knows for businesses to ensure correct filings.

How to verify the revised income tax return?

Once you have filed your returns, it is important you verify it to complete the filing process. You can verify your filings by two means: online or offline verifications.

In offline verifications, taxpayers can download the ITR-V (acknowledgement form) and undersign it. Taxpayers can mail the form to the Centralized Processing Centre in Bangalore within 120 days of the form being uploaded. Once received by the department, you will receive a confirmation email.

In online verifications, taxpayers can verify their returns via the following means:

- Digital signatures

- Electronic Verification Codes

- Net banking

- Bank account

- Demat account

- Aadhaar card

Additionally, with the simplified processes, businesses will now need to upload their invoices for the financial year. Creating and managing invoices may seem like a daunting task. With Instamojo, create GST-friendly invoices using the Invoice Generator app and create an organized way of filing your taxes and returns!

4 comments

This is a very nice article. Thanks for sharing.

plz, check my link.

Helpful and an informative!

Nice article. Very helpful. Is there any app to fill income tax returns online.

Interesting Guide

Thanks for sharing