The RBI issued a statement a few hours ago, that banks and other card-issuing companies will disable online payments on all debit and credit cards that have never been used for online or contactless transactions – both in India and internationally.

A study by Financialexpress shows that India has over 52 million active credit card users and over 840 million debit card users as of January 2020. So what happens when a majority of them do not have options to pay online without using cards?

You provide them with alternate online payment solutions!

3 Best alternate online payment solutions for MSMEs to provide customers:

UPI (Unified Payments Interface)

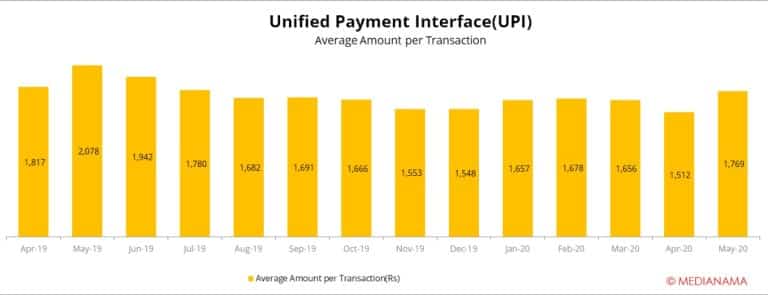

You can request your customer to pay you online using the country’s most powerful payment mode – the Unified Payments Interface or UPI. According to Medianama, UPI payments saw an increase of 23.5% between April and May 2020.

Why UPI: The WhatsApp Pay feature, a UPI-based payment mode, is currently awaiting a Supreme Court verdict to launch the payment service for Indians who use the messenger service. apps like GooglePay, BharatPe, and PhonePe already incorporated UPI

According to our COO, WhatsApp Pay could help onboard the next 100 million users for UPI must faster!

Netbanking

Customers can also pay you online via net banking. India is expected to cross around 150 million users for net banking services by the end of this financial year. On Instamojo too, there are over 60 banks that customers can access when making online payments.

Digital Wallets

Digital wallet apps like Paytm, Zeta, and allow your customers to make payments using money pre-loaded into the app. You can accept online payment from your customers via Digital Wallet or E-Wallet using Instamojo. Digital wallets have UPI and QR Code payment options too.

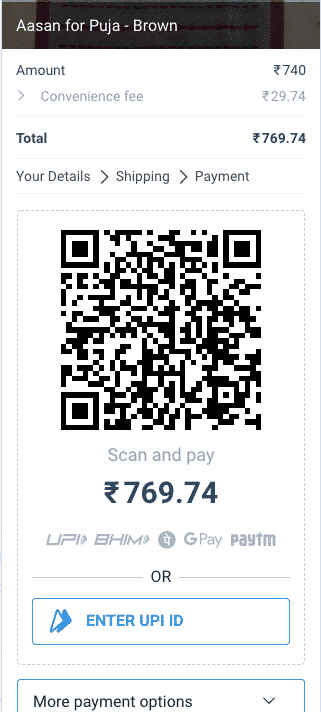

QR Code

One of the most popular used payment modes during COVID, this contactless payment option is a great alternative for payments of any size. Besides using QR codes in khirana stores or via apps, you can also provide a QR code payment option to your customers via Instamojo.

Online payment links

Payment gateway like Instamojo provides small businesses with the option to send payment links to customers. All you need to do is sign up and generate a payment link. Your customers will receive all the above payment modes, so the choice of payment is theirs.

Why did the RBI cancel card transactions?

The RBI has requested banks to not allow international card payments unless the customer specifically asks it.

Debit and credit card services will be enabled for transactions at ATMs (domestic) and Point of Sale terminals.

Cardholders will also have the option to switch on/off their debit and credit cards for any facility – ATM, NFC, POS, or contactless transactions.

RBI’s new rule aims to reduce the rising cases of credit and debit card fraud in the country.

How to protect online transactions?

Simply put, make sure your business is reliant on a trusted payment gateway/online payment solution when you transact online. With Instamojo, you can be assured of safe and secure online payment solutions due to:

- Timely payments: Zero delays in the payouts receive (T+3) days. If you are willing to spend a little extra, they also have a faster payouts option – 3 of them in fact. You can check them here.

- Easy to use: Fast loading, quick to redirect and pretty smooth UX. No IT knowledge or developer assistance is needed to navigate or build/use any of the features/apps or tools.

- Secure and safe: Instamojo is PCI -DSS compliant. This way, your transactions are 100% safe.

Therefore, do not worry about giving your customers more options to pay online. There are several alternate online payment solutions to choose from!

CHOOSE INSTAMOJO FOR ONLINE PAYMENTS