Introduced in 2017, GST in India replaced a large portion of indirect taxes levied by the Central and State Government. This eventually led to the takeover of India’s tax landscape.

Two years since the implementation of GST, a lot has changed. Let us take a look at the past, current and future state of GST in India.

GST Registered Businesses in India – An overview

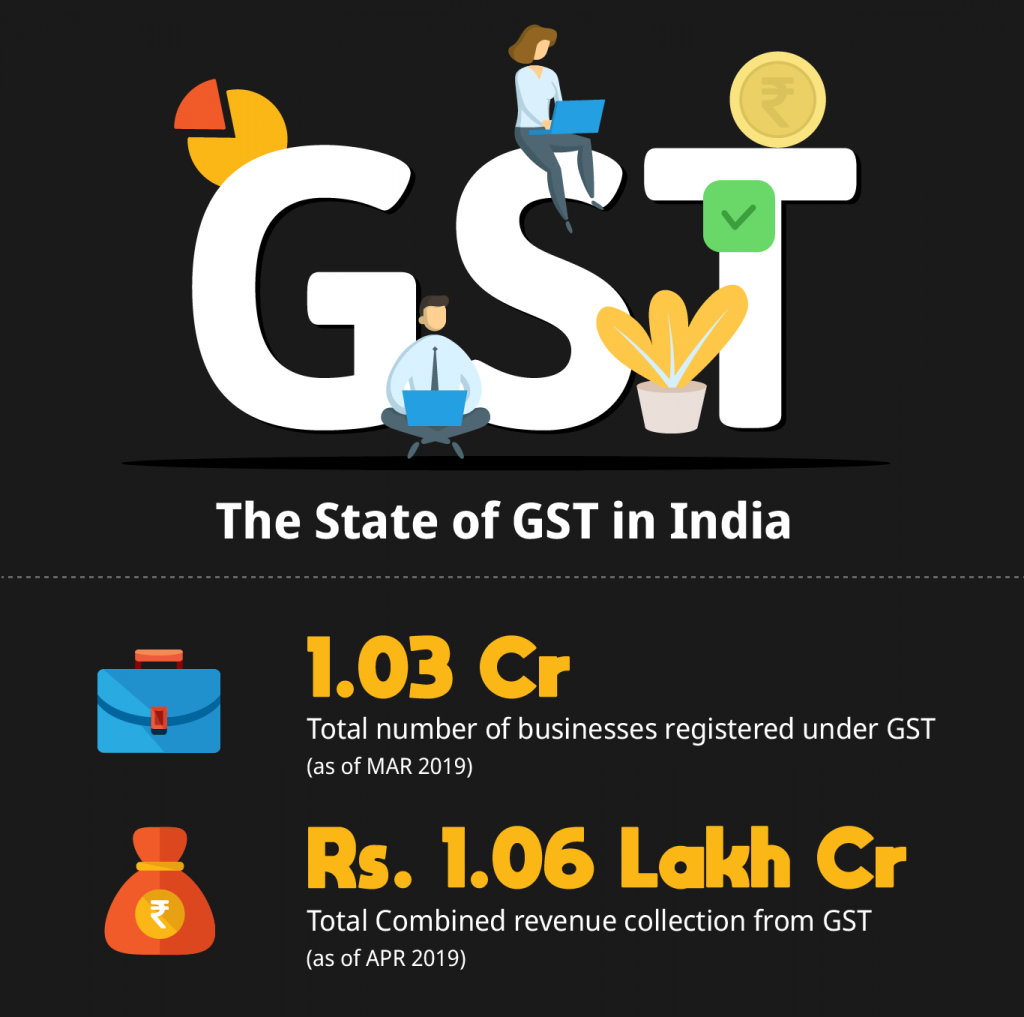

A total of 1,03,99,305 businesses are registered under GST. This includes almost 64.42 lakh existing taxpayers and 39.56 lakh new registrations under GST.

The total GST revenue collections during the financial year 2018-19 were INR 11.77 Lakh crores, along with a monthly gross average of INR 98,114 crore.

How has GST helped small businesses? – Decoding the present

‘One nation, one tax’

The primary intention to have a ‘one nation one tax’ plan with GST was to:

- Ease business operations for taxpayers

- Introduce transparency

- Ensure timely compliance for businesses

- Ultimately reduce the tax burden for the common man.

There are significant changes made to the Indian economy post the introduction of GST. Furthermore, this year, the GST exemption limit doubled from INR 20 L to INR 40 L. This led to more businesses registering for GST.

Before the budget 2019, the GST Council held over 34 meetings to take important decisions along with recommendations to the government on issues like reducing the compliance burden for taxpayers, providing sector-specific relief measures, etc.

Also, with the upcoming budget 2019, It is expected that the trend of reforms will continue. There has been an increased focus on:

- Providing relief measures for industrial sectors

- Ensuring speedy clearance for pending export refunds for small businesses

- Revised GST filing for small businesses: The main focus of the GST council was to ease processes and improve compliance that could potentially benefit 93% of taxpayers. Additionally, rate cuts on consumer goods seem like a welcome change for consumers too

Instamojo’s take on GST in India:

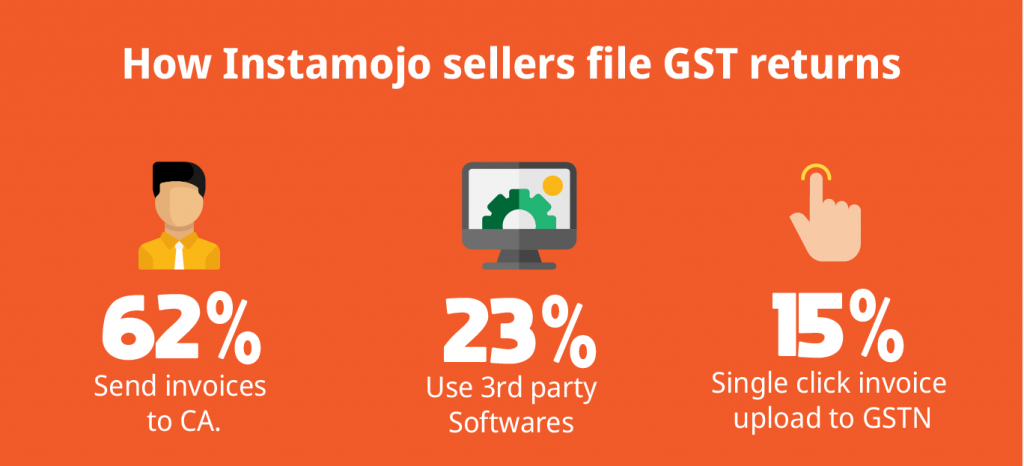

GST is a revolutionary move that saw significant changes in the way businesses handle their taxes. To adapt to the changing times, we introduced an easier way to help businesses cope with the dynamics of GST.

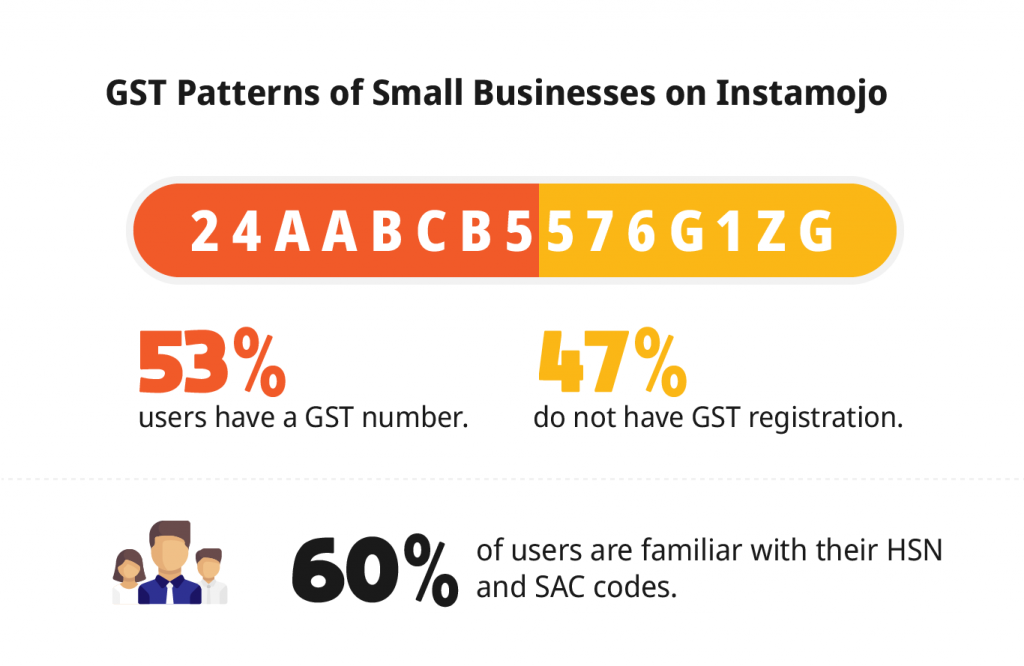

The Instamojo GST Invoice generator helps you download your monthly invoice report to download your tax. In return, it has helped us track how many businesses have registered under GST.

What is seen in the future of GST in India?

The future of GST can be foreseen with the demands made by MSMEs for the upcoming budget. Therefore, it is important to perfect the complicated system and ease compliance further.

In the next 3-5 years, there is hope to see an increased focus on stabilising GST revenue; for State and Central levels.

GST revenue could get a boost, with the implementation of the new return filing system with perfect invoice match to avail input tax credit.