Are you a small business looking for capital to boost your business or start one? While several private banks offer MSME loans, you could consider taking a look at these small business loans by the Government of India.

Types of small business loans

Broadly, there are three categories of business loans you borrow into. These loans are specific to what your business currently needs. You can also choose based on the stage of business that you’re in.

Working capital loan:

Working capital is your business’s daily operational cash flow. It is money you need to meet your day-to-day business expenses.

All your operational costs come under working capital and some loans are crafted to suit your working capital needs alone. The loans are offered typically for a 12-month tenure and have an interest rate of 12%-16%. These can be either secured or unsecured.

Read: 5 Working Capital Problems Nobody Told You About

Corporate term loan:

If you want to make investments in specific business areas or have an ongoing need for working capital, you can apply for a corporate term loan.

Therefore, if you are starting up, you may want to look at term loans/funding. These are large sums of money borrowed from banks or financial institutions that are expected to be repaid over a longer time.

These loans are secured (company assets) and have a longer tenure and the interest rate is negotiable. They can be converted into equity options and also have tax benefits.

Line of credit:

Line of Credit is an ideal small business loan for those who need financial aid at regular intervals.

With a Line of Credit, the business can apply for a loan amount without taking the entire amount in one shot. This loan has credit lines from which the business can draw funds at any time, without going through an application process.

This can be secured or unsecured.

Related read: Where can you apply for a loan of up to INR 50 Lakh?

5 small business loans by the Government

The Government mentioned accommodating MSMEs as their core priority in Finance Minister Nirmala Sitharamans’ MSME budget speech 2020 recently. To facilitate this, the Government partnered with financial institutions and banks to help MSMEs get better credit.

If you are planning on starting something of your own and require money, you can consider one of these small business loans schemes offered by the government of India.

1. The Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGS)

One of the biggest challenges faced by MSMEs is with regard to quick access to credit. The Credit Guarantee Fund Scheme is run by the Government of India, in collaboration with SIDBI (Small Industries Development Bank of India).

The purpose of this loan is served in various aspects but it is mostly focusing on giving loans to unsecured loans to businesses. The scheme permits the loans upto Rs.200 Lakh in either term or working capital loans as per the eligibility criteria given to the businesses.

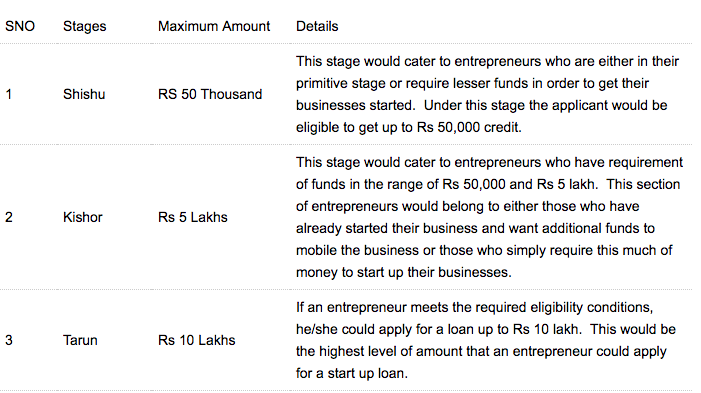

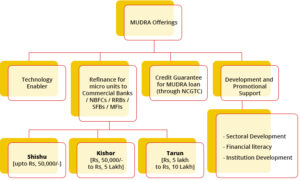

2. The MUDRA Loan Scheme

MUDRA stands for Micro Units Development and Refinance Agency Ltd. It is an agency launched by the Government of India to facilitate corporate term loans to entrepreneurs. Take a look at the Mudra Loan Scheme features in this table below:

Source; Mudra org/offerings

3. Stand Up India Scheme

The Stand Up India Loan Scheme for Women is a special small business loan scheme started by the Government to financially empower SC/ST and women entrepreneurs. You can borrow between ₹10 lakh and ₹1 cr. to start a manufacturing, trading or service unit, which is to be repaid in 7 years.

- 85% for the project cost include term loan and working capital.

- The interest given on the loan is 3%.

4. National Small Industries Corporation Subsidy

The loan aims Micro, Small and medium entrepreneurs in India by encouraging, assisting and helping to bring in growth to the business catering to various sectors.

This loan for small businesses is a subsidy Government loan that offers two main benefits:

- Meeting raw material requirements

- Marketing assistance

This govt loan for business provides access to indigenous and imported raw materials as well as funds to improve the market value of products. NSIC is primarily focused on funding small and medium enterprises that wish to work towards their long-term growth.

5. Credit Link Capital Subsidy Scheme

What NSIC provides in terms of raw materials and marketing, the credit link capital subsidy scheme does with technological upgradations.

- The benefit is the MSMEs should have UAM number

Under this loan scheme, the Government hopes to help MSMEs reduce production cost. Under this scheme, you can get an upfront 15% capital subsidy for your business. The maximum amount of subsidy is ₹1 cr.

Related read: 7 Best Government schemes for women entrepreneurs in India

Loans are not a bad idea, but you have to pick right! Luckily, we have a free ebook that can help you pick the right funds for your small business.

This ebook answers all your basic questions on small business funding.

1. Why does a small business require a loan?

2. What to consider when taking a small business loan?

3. How are small business loans different?

4. Where to apply for a loan? and more!

Download the free ebook to get all your small business loan queries answered.

136 comments

The article really helps in understanding the Small Business Loans Offered by Government of India. But the problem with these small business loans is that they are not collateral free. Most of the Small Business owners have nothing to offer or mortgage for a loan. Money lending firms like Lendingkart helps such owners by providing Collateral free loans with Flexible Repayment Tenure.

The article really helps in understanding the Small Business Loans Offered by Government of India. But the problem with these small business loans is that they are not collateral free. Most of the Small Business owners have nothing to offer or mortgage for a loan. Money lending firms like LendingKart helps such owners by providing Collateral free loans with Flexible Repayment Tenure.

Good article. This is a well timed reminder. we will get very trapped in our services and internal problems that client focus can become clouded. If we always come to the client successfully driven intentions, referrals happen organically. People mention what they like, make them like your business and they’ll do the remainder

It’s a informative blog…

There are so many business loan providers in India that it might get confusing for new entrepreneurs. This article is really helpful in understanding Small Business Loans offered by the Government of India. Apart from these schemes, you can also opt for startup business loans from Lendingkart. If you are planning to start your own business, you can approach Lendingkart who provides loans up to ₹ 2 Crore. The best part about these loans are that there is no requirement for collateral to get a business loan.

Your article very helpful, I like to visit your website for reading those articles.

Thanks for sharing such very useful and very educative article like this. This is very helpful. Really nice, Keep it up.

Thanks for sharing an informative info, this will help to get business loan.

Thanks for sharing, this is good these small business loans schemes offered by the government.

Hi

myself Kushal i just started a business but I need a loan to the business

can you tell me how to fill the govt loan form

Thanks for this post.I need more details for Corporate Term Loan?

HI,

I am Shashi. I want start a small restaurant in our city.so please give the information for loan. Because I want start early to small restaurant.

Thanks. Mob:-+971565608122

Wts app:-+971521323300

We established a new portal like amazon thatbis alfaaz .in

We need fund rice our new e com

business like amazon in their b2c service in all segment plz caal us 9844109109

I am optimistic and wish to start a new business. I would like to start a Book shop. Kindly guide me to move forward.

I need a bussiness improved loan in non security loan

I want to start a preschool, but do not have the relevant amount.

I am a woman with a child. I am ready to take a loan but with low interest rates.

Will the government help me?

Hi…

Iam looking for working capital to start up my own Franchise..

gundu.4254@gmail.com

I need loan for business for manpower supply and agarbathi making purpose.

Dear sir/ mam,

please inform me any loan or subsidy for start food buisness in maharashtra ?

You can look at http://www.DeAsra.in

They help with loans like in your requirement.

I want to make agriculture machinery and heavy equipment machinery manufacturing

I need to create ITI machanical engineering more jobs

1, engines service

2,electrical services

3, hydraulic system services

4, transmission services

Business loan sounds like the best type of loan indian goverment is offering.

Well Written Article

Your article is very helpful to me. Actually i am was finding article about “Apply for Small Business Loan Easily”. Then i found your article. its great information. Thanks for sharing such a good content.

Its hard to choose best option. Govt has provided various scheme and private lenders also have their strong network. So before applying for small business loans please check the source.

I need a loan for furniture industry which can supply all of Mizoram state and other NE States. I am certain becoz i had many furniture manufacturing ideas which are only available in Europe and US.But I need atleast a standup India scheme loan .

Business development

I have registered a PVT Limited company . Need loan for logistics services

You don’t need a loan! You need http://www.instamojo.com/mojoXpress

Try our shipping services to check your needs.

Hello,

Mam, I have pvt.ltd company . my business is import export and i need workin capital.

You can take a look at: https://www.profitbooks.net/working-capital-loans/

Hi

This Guru Murthy , From Bangalore , I want startup Business Loan For Run My Teleshoppy Company . I Have Register My Company . I want 5L To Run My Company So Plz Give Me Startup Loan For Running My Company.

I think there is some mistake in this post in Mudra loan – Kishor stage. as I have read at other websites they say you have to have a business running to get this loan up to Rs 5 Lakhs. If someone wants to start a business using this money it is not possible as they have to show the already established company to get the loan.

please support for your help

Thanks, Rapti for sharing these small business loans by the Government of India.

Í need 10lakhs for business

I want to start a small business. But i have no working capital. Can i get any financial helps with lowest interest? Can you help me ?

Hi Basheer,

If you are looking for working capital loans, you can check out this article.

Thanks for sharing such an amazing information where you have given complete information about working capital loan… here we are also providing information about working capital loans which is useful to all…for more information about working capital loan you can be free to contact us and get instant approval

Hi …! I am looking to get a finance … As per your terms….( term loan ). I need to start my own Business loan … And I am looking for 6 lakhs of funding … !

We are a two decade firm, trading into ‘Trims & Profiles’ – Specialized products made of various material to Protect Edges & Corners of any Construction (from Houses to Airports). We are wanting to invest more on our ‘Marketing’ in this business and also want to diversify with newer products & services (Design & Installation) that can easily compliment our existing infrastructure and manpower. We have lined up few options and are in need of working capital to a tune of Rs.25 to 30 Lakhs. Please advise on available venues in Govt. Schemes for MSME. Thank you.

There are various loan schemes offered by the Government of India that are aimed at helping small scale entrepreneurs to take their business to the next level. Micro-Units Development and Refinance Agency Ltd (MUDRA) is an agency launched by the GoI for developing and refinancing corporate term loans to entrepreneurs. Vijaya Bank has co-branded with Mudra Ltd to facilitate V Mudra Card.

Myself Sam i am running garment bussiness inorder to expand i need a loan from gov..in which it should be of low interest…could you pls give some idea about this type of gov schemes..

I need the loan up to the 10 or 14 lakh for stablish the vacceine house after 8 months so please suggest me.

Right time my earning is 5000 rs. Per month

I want 5 lakhs to start a bakery shop what is the procedure to get the loan and what is the interest rate

Great piece of information over here.

You have shared some fantastic points about business loans that I never thought about.

Thanks for sharing!

I have applied for loan in PMEGP scheme andmy loan is not approved yet. Its been more than 6 months. what should i do i want to start my own business.

I have a startup in bakery and juice, I got a license from the mod (goi) in HVF, Avadi, Chennai. I have already paid my security deposit for govt. shop in HVF, Avadi, Chennai. I need some finance for my startup bakery & juice counter but banks need the previous record, I don’t have any previous business record, but I have the experience to operate such type business, can anybody help me to arrange finance, I need only 3 laks, I have already invested too much amount for govt. license. Please help me.

Hi Amit,

YOu can avail a multitude of schemes that the Government offers. The blog will redirect you to reliable loans and schemes with very low-interest rates. We wish you luck with your business.

Thank you for sharing all these information.I read these three great small business loans.I have already involve in the business.Its a great knowledge for me and for my business.i will share to the friends.

Please do, Thank you!

Thanks for sharing the information. For Small Business, Which department sanction the loan? MSMEs or Bank?

Hi Ankita, it’s the bank that sanctions the loan, although the scheme is provided by the Government for MSME Sector.

I need a loan for start up of business in karnataka

Hello Madam

We are running Online cake shop business Crust N Cakes in Gurgaon location and we are going well but now we want our business in multiple cites, that’s why we need some fund which can help us to grow our business. Please help us Thanks

I need a loan to start a agriculture based business.

Where can i get a government based loan?

Pl suggest.

Please check our blog on the best loan schemes for agricultural businesses here – https://www.instamojo.com/blog/government-schemes-for-farmers/

i am asesh bhattacharya. I am 55+ from Purba bardhaman,westbengal,india.I started a stationary cum variety shop in my village from 26th aug. 2018.I need rs.500000/- loan to develop the shop.I have no land to mortgage and no gold to get gold loan.plz help me to get loan.

I am planning to start a fresh water fish farming in Kerala state. I would like to know that I can get a government grand and a loan???

Hi,

I am looking for angel/seed investors for my business idea. Can someone help

i need buisness loan for machinery & land to do wood work i am experienced in this feild in 7 years please tell me about this

I want to start school how to take loan with in month

Dear sir/madam

I want loan on basis of our company veritas engineers services pvt ltd., Company register in 2015, So request provide an amount ASAP.

Thanks

I think stand up India scheme can work for the new entrepreneur and the startup business. The small business owner can leverage this scheme, to take their business on new hight.

I had applied before for small business loan at one of the government institute. Everything was good but process was slow. I was looking for urgent business loan but at the same time my sister suggested me to go at Indexia Finance for business loan where I got fast approval, lowest interest rate & no time consuming process.

i take franchise so i want to loan i need 5 lac. can you please help me

Madam I want to start a small restaurant. For which I need Rs. 50,000/ to 1,00.000/ as loan.Please guide me for the same

I am going to purchase a small tea garden (part of closed tea garden) need financial support. Please help me to something on my own.

Hi mam… I want a finance support to start a small scale industry such as note book printing industry so plz guide the route to get financial support ……

I needed loan for my business. I opened a general store. That’s why i need Amount of = 100000

i own a security company. All registrations along with licensing are now done.We even have contracts awaiting initiation.

We need capital to make this intiation smooth.

This is really helpful, but it’s very hard to get loan for startup from bank or government. So I applied for Startup business loan at Lendingkart & I will get the disbursal in 3 days.

I am looking for a financial support from govt to expand my water business. What is the procedure and how do I get help from govt.

This is one of the best bussiness related guide i ever get on internet. It Really helping me a lot in all my bussiness loans proceedings and work docs. Thanks a lot for sharing such very good quality and understanding information with good information. thanks again.

Great!!! Thanks for providing great info.

I am in Coimbatore, Tamilnadu.

I want to start a play school.

For this purpose I need Rs 700000 in the initial stage.

Can you suggest me who should I meet or approach along with their contact details

Expecting your reply

Thanking you

With Regards

Hi Sathya

We hope you found your answer. We recommend speaking to a network of playschool entrepreneurs via social media to know a trusted lender for your kind of business. Also, you can avail one of the schemes listed in the blog to fund your small business.

I want to start small industry

So I m want loan for this

I want to start a manufacture business. Can I get this type of loan??

Hi, ours is a regd. partnership firm in cochin, kerala. This is a govt. approved MSME manufacturing unit. We are one year old. We manufacture & export various food products. Already exported to Australia, Kuwait etc.

We presently enjoy OD limit of Rs.30 lakhs from a bank. We urgently need funding of Rs.30 lakhs to better our infrastructure to export bulk quantity to various countries. We are holding confirmed export orders from regular clients. Can any one help us with required funding to take our business to the next level. Thanks

It’s all humbug.

Mine is 3 months old business with GST registration and current account. I need some fund to expand business. Even after showing turnover of Rs. 20 lakhs so far, my own bank is asking for security for CC and overdraft or any other loan. I confronted several nationalised banks to find out if they could lend me loan under govt scheme, but none gave satisfactory reply. All raised hands saying by business should be atleast 3 years old with 3 years ITR . So, how does a “STRATUP loan” suffice with such conditions?

Once you apply for loan online, you get hundreds of calls from some loan consulting companies (mostly from Delhi) every day saying that will help you in getting loan under PM Mudra yojna or any other govt. schemes with 35% subsidy. Once your documents are verified and found genuine (which have to be), they inform you that your desired loan could be sanctioned and they send you KYC form and ask you to deposit Rs. 1000 to Rs. 15000 as a their fee to prepare a project report by CA. Then, after your loan is approved, you have to pay them 5% of the loan amount. I have been cheated once for Rs. 1500. The moment you pay them the money, their reply would be “sorry, unfortunately your loan has been declined”.

So friends, better don’t be greedy and do not keep hope of any such schemes. Just look around you. You would hardly find someone who must have availed loan under these kind of govt schemes. Instead try other sources like borrowing from friends and relatives or selling your ornaments.

Dear concern, my self Rashmi Gupta, I am planning to start my business & need funds. Please suggest me how can I proceed my plan for got loan upto 10 lakhs.

Thanking you.

We also offer loan for all kinds of legal business. Loan for small business and investments of all kinds are also available. All amounts of loan is available both secured and unsecured. For more info contact us now at

I need loan to buy a machine and also to buy a house too.

Hello.

We provide all types of loans. So call me or whats app me – 8108460673 – Mohit Darji.

I need to start a man power supply company I need financial support and I am looking for a loan is it available

Hello.

We provide all types of loans. So call me or whats app me – 8108460673 – Mohit Darji.

dear madam, myself shabana , iam looking to start a new business of paper plate machine with women manpower ,can u help me

Hello mam, we are running a paddy/rice business with small capital for the past 6 months. This business is good and we got some good parties regularly. Now we want to expand our capital. Pl. Advice us on govt. Loan schemes.

Kalpana.

how can i get business loan to start my business

I am running business from last 7 years .i am expanding business. So i need working capital loan.

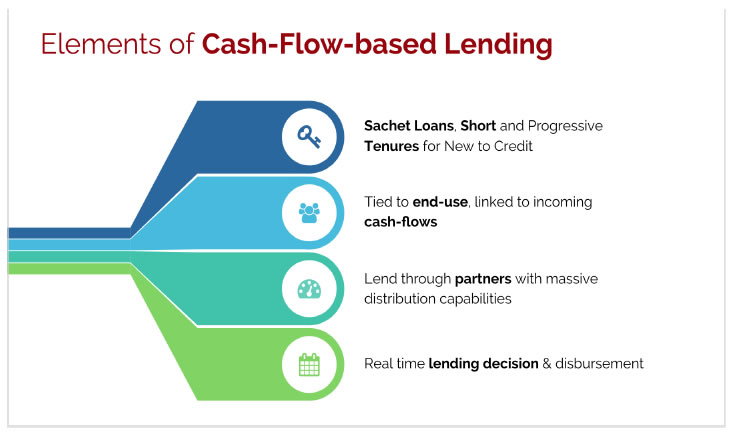

Please refer this link – https://www.instamojo.com/blog/cash-flow-loans-small-business-needs/

We hope it helps you!

I want to purchase Cnc machine up-to 15 lack. I need loan without mortgage. I have government orders above 10lack and 3year itr and all documents but not any thing to mortgage.

I have Computer & Zerox shop, online application and other online works done here. I need to buy few more computers and Zerox peripherals, So I need loan. Please help me in this regard.

i am running an placement agency from last three years ,now i am thinking to expending

my busnines plz help to provide a loan

Loan Lana ka Liya sampark kera mobile no 8932836078

Hi,

I am looking for working Capital for business. Can you please help to get the loan.

Hey Tanweer,

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

i have need working capital for business

I want capital loan 25 lac for black pepper import.

I am running the pvt Ltd company for last 4 years .i am expanding business. So i need working capital loan.

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

I want fund for start bussiness

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

i need a business loan on tailoring shop it is started from 20 yrs & we had a 2years ITR for improving a business, we are looking for loan amount around 5 lakhs…

please get back to this ID

I need fund for start up I have a working insence stick making machine and I need start this ,help me

My business start in running a 2.6 months and I standing in future I want a loan so please give me loan

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

Business loan

How do I apply.

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

I am looking for 10 lacs loan for my new business setup … kindly revert to me

9764098962

Please write to support@instamojo.com with your request. We could help you with something that might interest you.

I want to start a new business and for that i need a loan of 15 lakhs how can i get it and from where i can get it.

I need finance of 5 lakhs for my manufacturing startup but the banks are not ready to provide any even after so much of initiatives by government.The banks are asking for financial details.To be practical if I have a strong banking why will I go for a loan,its common sense.Kindly advice how and where to proceed

I am in Bangalore my Peenya industrial small company manufacturing bakery equipments but I can improve the company more stock of machines I can want Loan amount approximate 800000 any help with your funding

My business is 6 months old now looking for funds for working capital and expansion as well, so looking for funds for Rs. 5 lacs.

HEY. I want to start a business for that I need minimum 2 lacs. Which kind if load would be better for me.

I have a small factory (furniture),I’ve been working,struggling and standing on my own feet for 5 years and now I’m trying to expand my factory,so I need to communicate with any government bank for getting a loan.

Hi, you can click on any of the links in the blog to be redirected to the official loan site for any of these schemes. Also, we suggest approaching an NBFC (Non-Banking Finance Corporations) if you are looking for low-interest loans to help your business.

All the best.

sir,

I am going to develop rural world of India. I left my job currently and now starting my organization Bardhiya Agro Industries Private Limited in rural area of Uttar Pradesh now I required some funds

Hi Jitendra,

If you are looking for funds for rural businesses, check the MUDRA loan scheme mentioned in the article. We hope it helps.

very useful and informative article to share.

I am running business from last 3 years .i am expanding business. So i need working capital loan.

Me ek 50000 ruPee ka loan cha rha hu mene bank ke kai chakkar lgaya par mujhe loan lene ki kamyabi nhi mili

You can write to me giving the following information:

1. Nature of business and products

2. Last year’s turnover

3. Whether you are having an existing loan. If yes, details.

4. Amount and type of loan you are looking at.

5. Collateral security , if any which you can offer.

6. Your location.

I am a retired senior banker and can professionally assist you. I write in Quora.com on topics of business and finance . You can go through them to have an idea.

My contact details: pharmacon 334@gmail.com.

call me for any loan requirement 7569155155 100% comission free no need to worry we dont take single rupee also

vijayashri financial services

guntur

cell no ; 7569155155

Hi …! I am looking to get a finance … As per your terms….( term loan ). I need to start my own venture … And I am looking for 30 lakhs of funding … !

Thanks for the information. Really these schemes are helped a lot. Thanks for good information.

Thank you, Amrita! Please do read our other blogs too. We would love to hear our feedback.

We Ankitech give great quality healing center furniture in India

Our doctor’s facility informal lodging types of gear are of top quality. We provide best quality beds like ICU bed, ICCU beds, Fowler bed , Semi bloom bed,Electric BedLabour Bed,Medical Furniture,Medical Table,Medical Trolley,Ward Furniture and Wheel Chair

We trust that we should furnish patients with particular therapeutic quaint little inns furniture.

Hospital Furniture

Hospital Bed

How can i got loan to start a small unit of meking jewellery and how much

Most business owners know that lending options are limited in our region. Banks and lenders need your business. But loan officers don’t have an incentive for helping you get financed.

That’s where we come in. We can help you develop your loan application with the information lenders are looking for. Then we shop your loan out to our network of over 600 lenders to bring you the best financing options for your company’s needs. We do the work, you pick the options that suit you best.Please call +1 (806) 331-5111 for all the details involved in Amarillo Venture Capital,INC.

hi can i get contact details of ur office in Bangalore..

What is the process of getting the loan for about 3 lakhs for a business.

Hi Manish, the blog will redirect you to the websites that offer these small business loans. You will need basic documents like PAN, Aadhar card and proof of business to provide them.