Even the most creative, passionate and eager entrepreneur can find it difficult to convince banks for loans. Don’t let that stop you. Switch to alternative financing for small businesses to get the funds you need. Here’s a small guide to get you started!

1. What is alternative financing and why do small eCommerce businesses need it?

Often entrepreneurs who have just started out don’t have a pot of cash stashed away to help them set up business operations. They might also need the funds for:

- Stocking up inventory

- Upgrading necessary equipment

- Hiring new people

- Expanding their operations

- Increasing cash flow

- Building a credit score

- Marketing purposes

- Getting insurance

- Paying rents

- Renovations

- Training and capacity building

This is when they approach traditional financing institutions like banks to get loans.

For small businesses, banks are usually not that keen on lending money. If you cannot secure the funds through this traditional route, consider alternative financing options.

When business owners get funds from places other than traditional banks, it’s called alternative financing.

When your small eCommerce business is in desperate need of money, or if you want to take the leap but you do not have the funds to do so, alternative financing for small businesses can be your saving grace.

Want to know more about how small businesses can get funding to expand their operations?

Check out our ‘funding for small businesses’ course for all your funding needs

Our free learning platform – mojoVersity, has all the necessary courses you need to build a successful eCommerce brand.

2. Why traditional financing options FAIL for small eCommerce businesses

Traditional financing simply means – borrowing from banks! It’s not that banks are opposed to lending, however, for small businesses, the process can be quite long drawn and disadvantageous.

Here are the main reasons traditional financing is just not suitable:

- Small businesses applying for loans are usually new and hence have no history of credit

- The regulations and procedures are lengthy with a lot of paperwork and regulations involved

- You would need collateral which might be difficult for a small business

- A lack of a solid long term business plan can also be grounds for getting rejected for loans

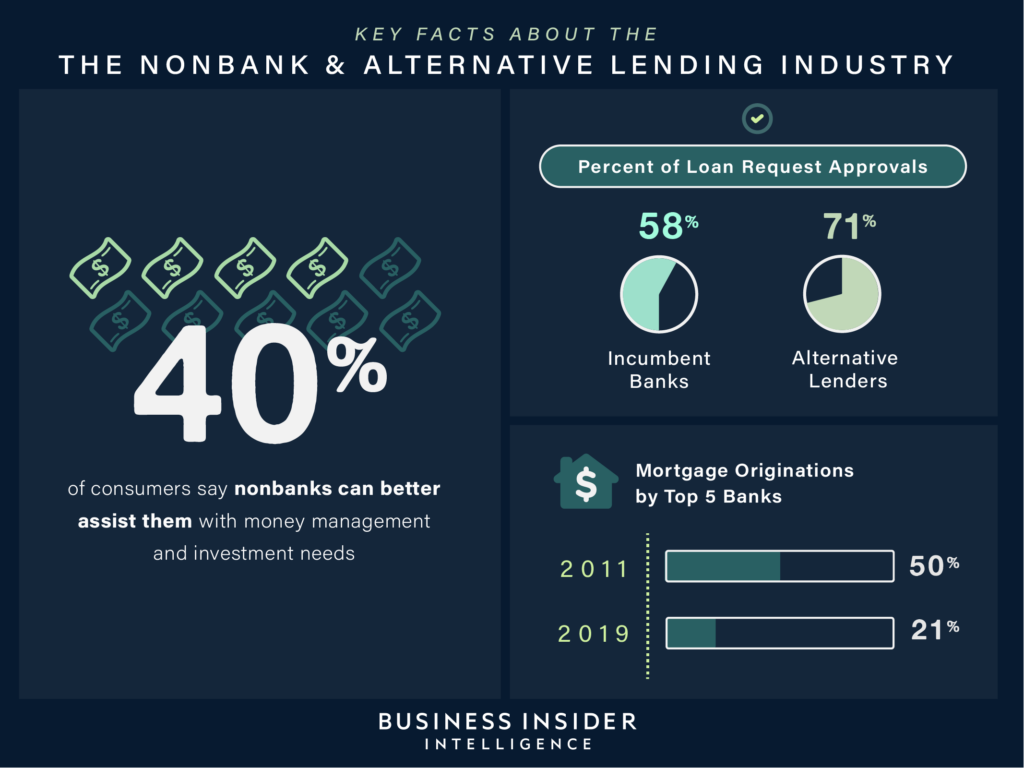

Now that we know how traditional banks fail small businesses, let’s also discuss why alternative financing may be the better option for you:

- They require lower credit scores

- Getting approval for credit from alternative financing institutions is easier

- Typically have much shorter wait times to get access to the funds

- Helps you preserve your bottom line and also get quicker returns

Small businesses and DTC brands choosing alternative financing is a major trend for 2022 and is expected to become mainstream soon! To know 5 other market-defining trends and their impact, download your own free copy of the eBook – Indian DTC brands eCommerce outlook 2022

3. Types of alternative financing for small eCommerce businesses

Going to banks for loans is now just ONE of the multiple options that small business owners now have!

Today, most alternative financing for small businesses is available online. You can easily apply for loans and provide the necessary paperwork, all from the comfort of your home.

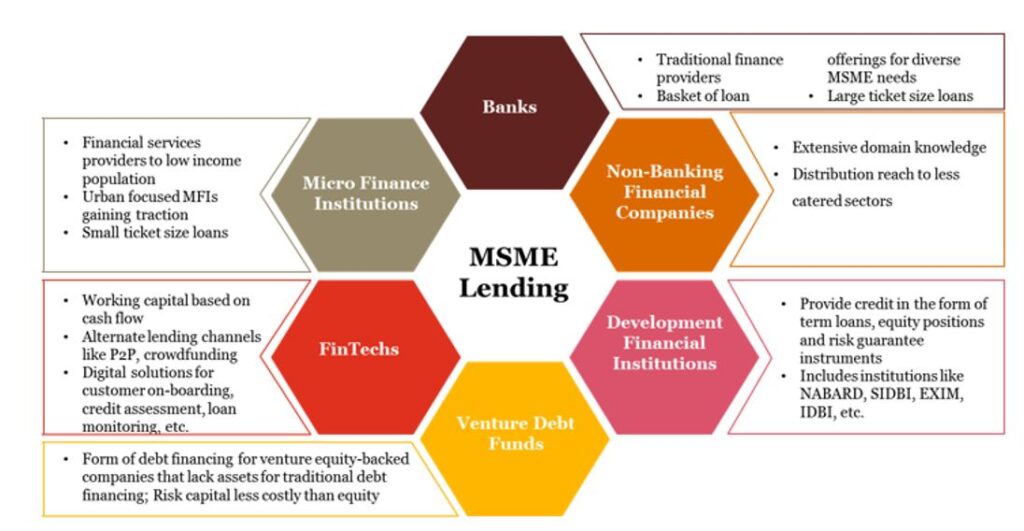

Here are some other modern alternative financing options available in the market today:

- Get funding from a non-profit development finance institution

- Give up part of your ownership to receive funding from venture capitalists

- Get a strategic partner who finances the business and shares the name

- Identify an angel investor. Angel investors are wealthy individuals who want to invest in startups or early-stage businesses. They usually take on more risks than venture capitalists.

- Peer-to-peer marketplace lending helps borrowers connect to lenders. It is a type of crowdfunding that takes place online.

- Digital lending with the help of Fintech (Financial Technology) apps

- Revenue-based financing platform is a type of alternative financing for small businesses because in this case – the revenue determines the loan repayment. For a simpler explanation – A person takes a loan, and only pays back a pre-decided percentage once they start earning.

Instamojo powers more than 20 Lakh+ small businesses. Once you create an online store, you get access to marketing tools, inventory management tools and shipping partners – all for free!

And now, we are also giving you the opportunity to fund your business. We have partnered with Klub – India’s leading revenue-based financing platform for online businesses.

See your small eCommerce business grow with a partner like Klub! Head to our app store to know more.