We have always heard precaution is better than cure. Many small eCommerce businesses often shut down as they do not have enough money to help them during troubled times. Having an emergency fund for small eCommerce businesses can be the difference between having reduced sales and shutting down altogether. You will also need funds to start an eCommerce business.

Here is a full guide on what is an emergency fund and how to build it.

What is an emergency fund?

Every small business needs to have an emergency fund. These are separate savings or funds that a business can use when they are in trouble. These funds shouldn’t be confused with savings for long terms goals or investments.

The funds should ideally remain untouched so that if any adverse event does take place, these funds can help you through the crisis. No business should ever think that they are 100% safe from uncertainties or crises.

Why do we need an emergency fund for small eCommerce businesses?

1. Uncertainties

The coronavirus was the biggest disruptor that we saw. It had the capability of shutting down millions of jobs and caused lockdowns that caused immense suffering and pain. Small businesses were one of the hardest hit during this period. This is why it is even more important for small brands and businesses to create separate savings only for emergencies.

You never know when your small online business might be disrupted by:

- Calamities

- Natural disasters

- Supply chain disruption

- Bankruptcy

- Lawsuit

- Medical emergency

- Family emergency

Having an emergency fund can help sustain your small business for a short time, while things get back to normal. This has been a lesson that every small business owner realised because of the global pandemic.

2. Savings over loans

It is also easier for small eCommerce businesses to have a dedicated fund that they can keep adding to while growing their business. The other option is taking loans or depending upon credit when there is an emergency.

In this scenario, there is a huge risk of the debt snowballing and you might get stuck in a vicious cycle of repayments and interests.

How to build an emergency fund for small eCommerce businesses in three steps!

Step 1: Planning an emergency fund for eCommerce businesses

1. Determine the fund amount and duration

The first thing you should do is decide on a goal. Is your goal to ensure your small business keeps running for a specific time? The goal amount should also be decided while keeping in mind that the amount should be enough to continue your current lifestyle and help you pay all your bills. The emergency fund is supposed to be an addition to your costs of living, not a part of it.

The rule of thumb is that an emergency fund should have an amount of money that can help you survive for three months even without any income.

But, every small eCommerce business owner has a unique requirement. While deciding an amount, keep in mind:

- The needs that your company has

- The fixed costs that your company has (The money that you would need to pay even if your revenue is zero)

- The potential pitfalls and risks it has

- Your lifestyle and expenses

- Your profit margins

- Health concerns

- Presence of external support (Like family or friends)

- Degree of dependency (Do you have children?)

2. Allocating funds

Now that you have an amount in mind that you want to save. Next is to understand how much should you save every month

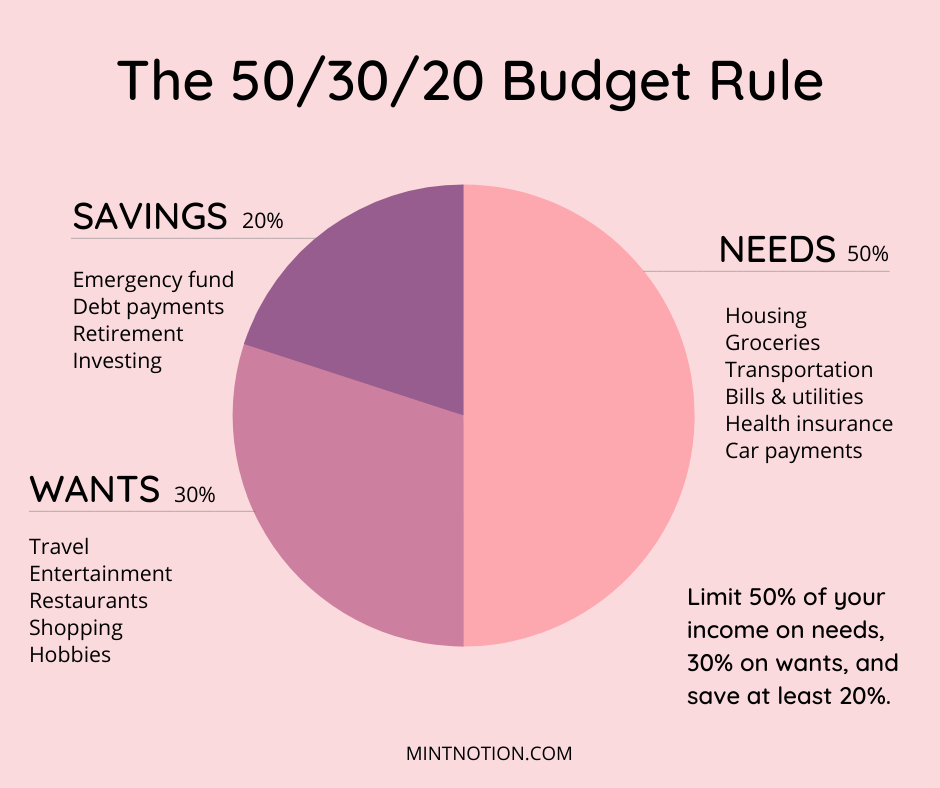

The easiest method to follow would be the 50/30/20 rule for budgeting. Divide your entire month’s income into chunks. 50% of your income should be spent on basic needs to keep your small business running. 30% of the income should go into ‘wants’, so things that you as a small business owner want to spend to help grow your small business.

The remaining 20% should go into your savings that should stay preserved till you really need it. An emergency fund needs to be carved out of this 20%. So that even if 10% of the money goes into buying a car or buying a house, the rest of the 10% remains untouched.

Here is a short guide on how to make a marketing budget for your small business.

3. Build a network

Even in the worst of times, it is crucial that you realise you are not alone. Instamojo saw 3 Crore, new users, on its platform in 2022. This is the year for DTC brands and small businesses to shine online. This is why building a network or community is important. Communities not only help you feel less alone, but the knowledge shared between similar entrepreneurs can also be extremely valuable.

Actively look for communities to be a part of on social media, or through your contacts. Having a steady network can be of use when you’re business is suffering.

Being part of a community can also help you gain knowledge about multiple professional organisations that can offer support to eCommerce businesses. In fact, you will also be able to gain quick knowledge about useful schemes released by the government.

Building a network helps you gain access to valuable resources helping you postpone your need to dip into your emergency fund.

Join Instamojo’s WhatsApp community to connect to like-minded small eCommerce business owners. Discuss and brainstorm with other entrepreneurs and amplify your strengths.

Step 2: Saving for an emergency fund for eCommerce businesses

1. Tracking income and expenses

To have an adequate emergency fund, and to constantly increase it, you also need to be aware of your businesses expenses. Tracking the incomes and expenses of your small business should always be a priority to ensure your small business builds financial resilience. Tracking your income tells you if you can slowly increase the funds you are keeping aside every month.

You should also consistently track your expenses like money spent on utilities, investments, bills, purchases, advertising, legal fees etc. It can also help you understand all cash outflows, making it easier for you to implement cost-cutting strategies.

Managing and observing your business operations on a daily basis helps you make informed choices about your savings, investments and your emergency fund.

2. Diversification of supply chain

It is important for your small business to minimise its risks. This also builds the financial resilience of your small online business. Some ways to build this resilience is by diversifying your eCommerce business’s supply chain. So that, even if one fails, you have the option of turning to another.

You need to ensure that you have diversified your:

- Courier and shipping service providers

- Warehousing

- Sales channels

- Fulfilment companies

Also read: 5 Affordable Shipping Services in India for Online Businesses

3. Discounts and sales

To ensure higher savings, you also need to ensure your cash flow keeps increasing. There are several ways you can boost profits for your eCommerce business.

- Run promotions on your online store

- Offer exclusive discounts

- Try early bird offers for digital events

- Hold festive sales

Read these blogs to know more about how to increase your sales using discounts:

- How to use discount pricing strategies to make more sales

- How to prepare your online business for the festive season

4. Technology-based solutions

Small online eCommerce stores should not shy away from leveraging technology-based solutions. If you are finding it hard to keep track of your income and expenses, there are several apps that can do it for you. From inventory management to managing finances, there are hundreds of apps out there that can help you streamline your business operations.

Financial technology or Fintech apps have recently gained a lot of popularity in India. From easy access to credit to managing existing money, these apps can be a blessing.

Instamojo has several such apps that can help you automate various business processes. Check them out all eCommerce apps here.

The lesser you have to worry as a business owner about multiple things, the better. Automation can help you save time and also significantly improve your savings.

Step 3: Implementing an emergency fund for eCommerce businesses

1. Keep it liquid

The objective behind the emergency fund is that it should be easily accessible. The best way to have funds readily available during times of need is to keep the funds liquid. Keeping funds liquid means that-

- You can withdraw the money whenever you want

- There is no penalty for withdrawing early

2. Spending it

The first rule of having an emergency fund is that – Keep it for emergencies strictly!

Do not treat the fund like a cookie jar where you dip into your savings for planned expenses like vacations or that watch you always wanted. The emergency fund should be kept aside solely for unforeseen negative events that require extra expenditure. Any expense that can be planned, like buying your first car, or buying a house from your earnings, should be done from separate savings.

For emergency funds, it is crucial that you keep replenishing them as and when it is used. There is no guarantee that you will never have to use it, even though we can hope our hardest. If a requirement does come up where you have no choice BUT to dip into your emergency funds, make sure that you start saving again as soon as possible.

No small business can ever be sure that it won’t need a safety net. It is always good to have precautions in place so that you keep your beloved business running.

Summary:

We never know when there might be a rainy day. Having funds ready is a smart business step that every small online business owner should take. Refer to this blog to protect your online business from sudden mishaps. Keep in mind:

- Plan what percentage of your monthly revenue will go into the fund

- Ensure the funds are kept in a safe and secure place (like a savings bank account)

- The funds must be easily accessible

- Track your monthly incomes and expenses religiously

- Take the help of technology-based solutions

As a small business owner, it is important to support other small business owners. This is why Instamojo has its own referral program.

If you are a small business owner who wants to set up their own independent online store for FREE, they can get started from today!

What’s even more exciting? If you know a small business owner that also deserves to have their own online store, participate in the referral program.

Get a chance to earn when they make their first sale!

1 comment

When starting out e-commerce business might require more of this fund as things are highly competitive now and the internet is constantly being updated.