How do you keep track of your payments? With an invoice of course! Every business owner needs to maintain an invoice with their vendors and suppliers.

Also, to avoid any confusion or fraudulent practice, it’s best to keep digital invoices. In this blog, we will show you the top 5 free invoice software and templates your business needs.

Why do you need an invoice?

Source: Frevvo

An invoice is an e-receipt that shows how much money is owed for any good or services provided. Invoices carry important details besides the amount.

Your business invoice includes:

- The details of the vendor and your business

- Information about items being sold

- Shipping cost and details

- Date of purchase and sale

- Invoice number – a unique number assigned to each invoice to help organise and track your invoices.

5 free invoice templates for your business

Free invoice templates are the most cost-effective option if you are a small business. Now that you know the essential components of your invoice template, here are a few free options you can use, based on your business.

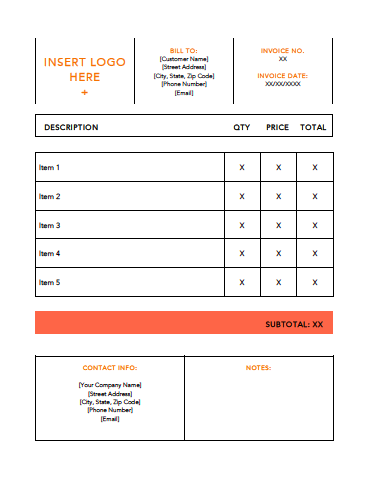

Standard Business invoice template by Hubspot

Hubspot offers free and professional invoice templates for businesses who are new to creating invoices. If you are starting out and need a quick, helpful way to create an invoice to send your customers, download the template, fill in the details and email it to your clients.

You can also click on the tools icon to the left to customize your colour scheme. Once completed, click the ‘Download Now’ button to download the invoice PDF.

Download the FREE Hubspot invoice template here

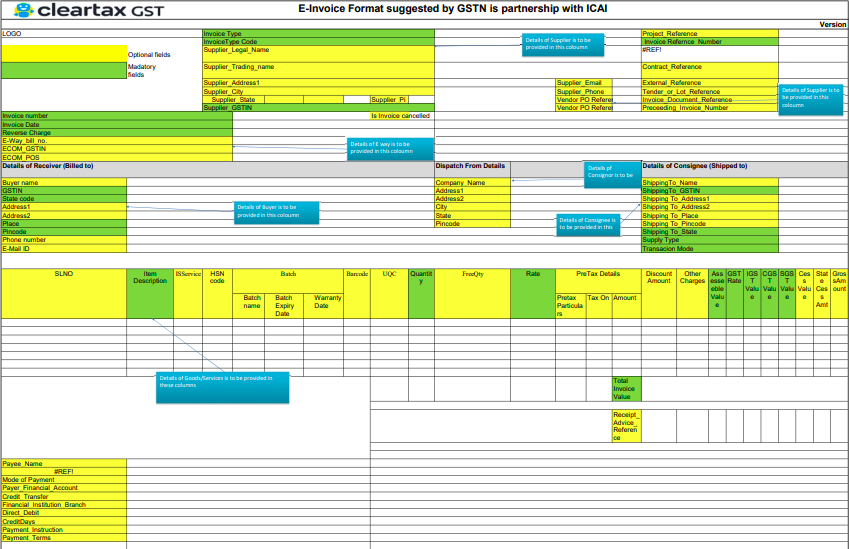

GST E-invoice template by ClearTax

It goes without saying that all your invoices must be GST compliant, else you will not be able to claim for Input Tax Credit. According to ClearTax, GST E-invoice is a standard format of the invoice recommended by the GSTN for all their GST registered suppliers.

GST e-invoicing is an introduction to digital invoices for goods and services provided by businesses. It is implemented by several B2B companies as a prime motive to reduce tax evasion – and to prevent fraud.

In short, e-invoicing is the new system through which B2B transactions are authenticated electronically by GSTN, for further use on the GST portal.

Here’s how it looks:

Download all GST information and templates here

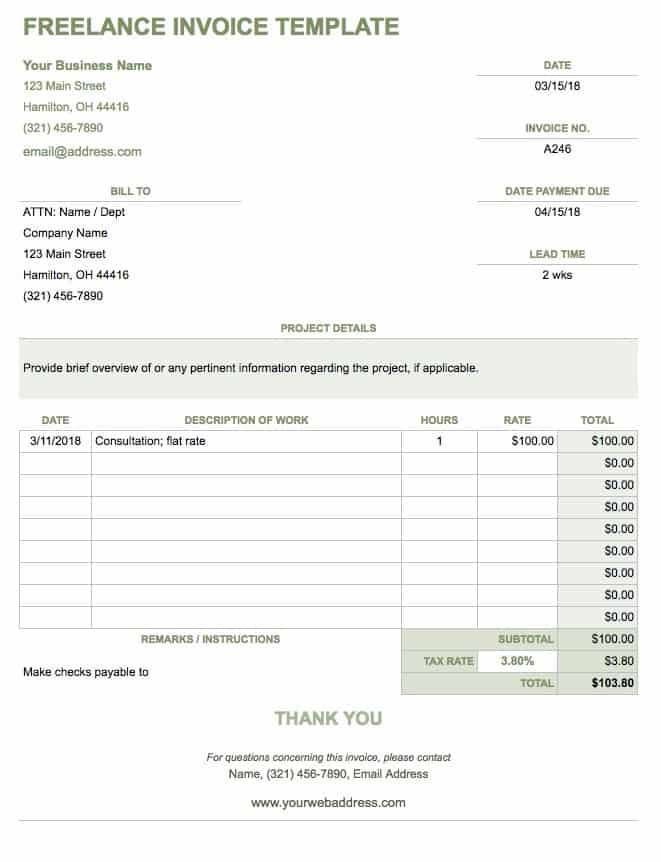

Professional Service Invoice

This type of invoice template works best for freelancers, designers, plumbers or any individual who has offered a professional service. Also, a professional service invoice works beyond just ensuring a payment, it can also be a ’business card’. The additional sections every professional service invoice must-have is:

- Time spent on services requested by the client (hourly)

- The rate for the services/ surplus charges

Here’s an example:

Download the professional services template by Smartsheet

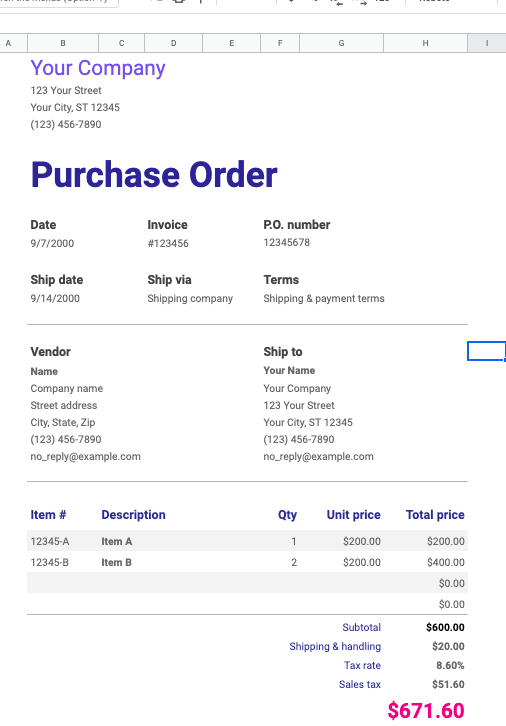

Microsoft Excel and Microsoft Word Invoice

Surprised? This is the most popular way of generating an invoice for your business, no matter what kind. A Microsoft excel invoice is generic and helps you add in your own elements, depending on the nature of the invoice. If you wish to create a purchase order invoice template, you can find it in the MS excel gallery. You will also find different invoice templates in MS Word too!

Here’s how it looks:

Download the FREE MS excel template here

Instamojo Invoice Template

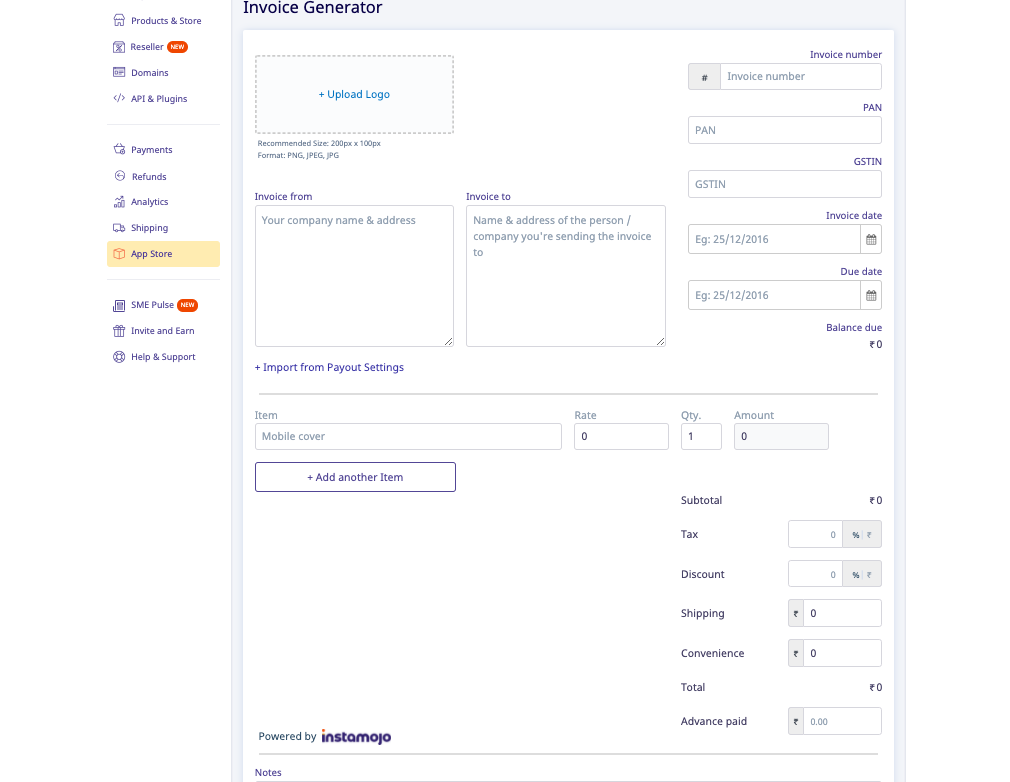

The Invoice generator app on Instamojo is completely free for all Instamojo users. No back & forth, no exchanging details – Invoices created on Instamojo are sent with attached payment links, so that your clients can pay you right away. All you need to do is sign up and head to the app store and subscribe to the invoice generator app.

Read: How to create an invoice on Instamojo from scratch

Here’s an example:

4 Invoice tips from other small businesses

Invoices are beneficial to your business, especially when it comes to filing for GST returns. Here are a few tips from small businesses that regularly use invoices:

Multiple-installment bills:

Make it possible for your customers to pay their bills in milestones. It is possible to negotiate for the best payment schedule between you, the client, and the project, whether it is equal payments over time, an initial deposit with the balance due later, or any other arrangement that works for all parties.

Set deadlines for invoices

Keep track of your GST returns filing dates and ensure you have collected all your invoices from vendors before. Setting a deadline is the most foolproof way to let your customers know you take the business seriously! Be clear in your communication and be a gracious client.

Automate your invoices

In the long run, it’s best to automate your invoices with your business clients, especially if it’s a long-term relationship. This saves you time and money and also removes any room for human error. Sign up for an invoicing platform like Instamojo, Freshbooks or Profitbooks to take care of automated invoices.

Easy payments solutions

Allow your customers and vendors to pay you easily. Offer them multiple online payment solutions. We recommend opting for a recurring payment option on Instamojo if you have a contractual relationship with another business. Also, ensure you always generate GST-compliant invoices.

Eager to create your first business invoice? Start here!