India has witnessed remarkable growth in the startup ecosystem over the last 5 years. With the world going online, it became important to choose the perfect payment gateway for startups to transact and collect payments daily.

But how can startups choose their ideal payment gateway?

Startups are going online this decade. From selling products/services through apps to collecting payments via UPI – the largest and most preferred payment mode this decade. How can the 20,000 startups in India collect online payments?

How do you choose a payment gateway for startups?

If you own a startup, you need to choose a payment gateway not only to collect payments from your customers but from your vendors and suppliers too.

But first, do you know what is a payment gateway and why do you need one? Here is an explainer for you.

As a small business just starting up, you need to look for payment gateways that are trustworthy, easy to use and reliable. Some of the other factors include:

Setup Cost & transaction fees

This is probably why you should carefully consider going for a hyper-popular payment gateway if you are just starting up a business. It might not be the right fit for your current business revenue.

Check how much your preferred payment gateway charges for each transaction. Compare, analyse and make sure it does not have long-term implications.

What does Instamojo do? Instamojo offers free setup and absolutely no maintenance cost. While many payment gateways levy charges as you use them for a longer period of time, Instamojo allows businesses to use most online features for free, with transaction fees at a basic 5% + Rs 3.

Related read: How much does an eCommerce website cost in India?

Safety and security

Is your online payment gateway safe? As mentioned earlier, your online payments are not just restricted to a customer, but vendors too.

A payment gateway for startups should comply with a bank-grade security level, like PCI-DSS and provide a secure encrypted environment for payments.

Opt for any fraud detection and prevention mechanisms. These features can be built into the gateway to avoid chargebacks and other issues.

What does Instamojo do? Instamojo is PCI-DSS compliant. Our compliance team runs background checks on all our sellers, every transaction is encrypted and in case of payment failure, an immediate refund is initiated.

Processing time

Startups need to make timely payments to their vendors. For this, your startup also needs to rely on a payment gateway that does not take too long to process payments owed to you. Check how much time payment gateways take to process payments – the ideal time is T + 3 days.

Payment method

Does your preferred online payment gateway support your payment methods? To ensure that customers and clients have different options to make payments easier, you need to make sure your payment gateway allows for debit/credit card payments, NEFT/RTGS bank transfers, e-wallet and UPI.

What does Instamojo offer? All online payment modes. Customers can make payments using UPI, NEFT/RTGS/IMPS, Debit/Credit Card payments and e-wallets.

International payments

When choosing a payment gateway for startups, make sure your preferred processor can facilitate international payments too.

Your business might get international clientele in the future, so, check if your payment gateway processor offers international payment options and if so, check the charges levied and make a comparison.

Transfer limit

How much money can you receive at once from your payment gateway? It’s typically the buyer or the client sending the money who pays for the payment processor’s services and fees, and not the receiver.

But, considering that your customer will likely be looking for the most affordable option, make sure you do consider the transaction fees before suggesting a payment option (a more affordable solution will also increase your chances of getting paid properly).

Instamojo online features for startups:

Being a startup ourselves, Instamojo understands the needs of small businesses and offers an array of online features for startups.

Over the past 10 years, Instamojo has worked to provide payment solutions that go beyond simply collecting payments for our sellers.

1. The Instamojo Online store:

As we said, we are more than just a payment gateway. The Instamojo free online store allows you to set up your very own customised store. There is no setup cost, no maintenance cost and of course, no limit on the number of transactions – once you complete your KYC details.

With the Instamojo online store, you can also enjoy a live chat feature that helps you collect leads. You can use the store to sell your merchandise, like tees, mugs or anything you know customers will want to buy.

2. Convenience Fee:

Instamojo convenience fee is a feature where any seller on the Instamojo platform can shift the Instamojo payment gateway charges to the buyer. The seller gets what they charge as MRP in their bank account and the Instamojo fees are shifted to the buyer.

For example:

The standard convenience fee charged at Instamojo is 5% + Rs.3 on a successful transaction.

What’s more? Instamojo also allows sellers to choose if they want to charge convenience fees to their customers. Sellers have the option to turn it off from the dashboard at any time.

3. Faster payouts

You are a busy startup, we are sure. So, why wait the normal time period of 72 hours to receive your payouts?

Keeping this challenge faced by startups in mind, we added the faster payouts feature to our mojoCapital – an option to choose the frequency of your payouts at your fingertips. Instamojo Faster Payouts is now on the Android App.

You can now choose from the following options:

1. Instamojo Next-Day Payout

2. Instamojo Same Day Payout

3. Instamojo Instant Payout

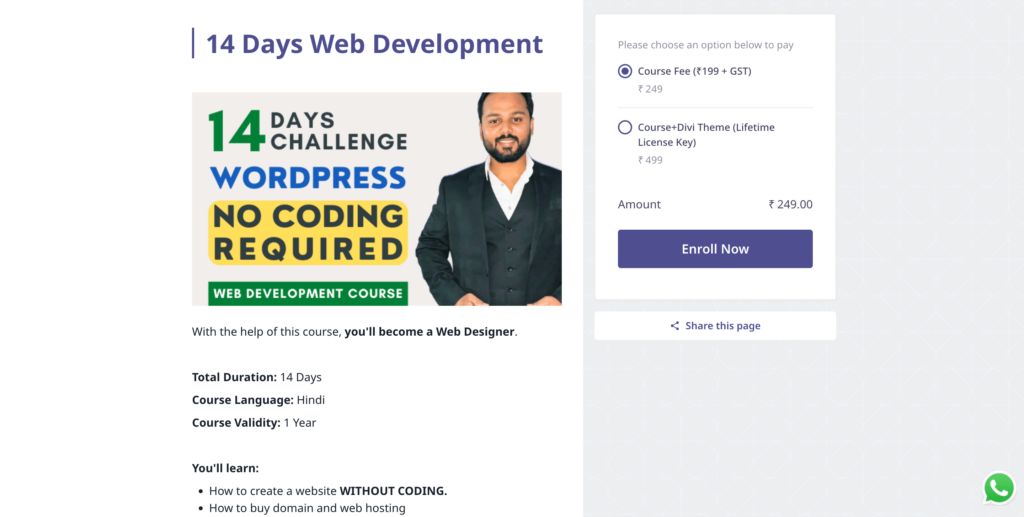

4. Smart Pages – the smart landing page builder

Well, if you want to collect payments for specific events, workshops or other service-based businesses- creating individual landing pages may suit you more.

The Instamojo smart page landing builder helps you build a single landing page that has an integrated payment gateway.

Look at how these smart businesses are using our landing pages to collect payments effortlessly.

5. Leads Manager

We understand you need to grow your business and assess your leads. For that, it is important to interact with your potential customers and tell them more about your product. So, we created a free new tool to help you manage your leads efficiently.

The Instamojo Leads manager on your Instamojo Dashboard will automatically pick out potential buyers who have dropped off (not completed their transactions) on Instamojo. You can then nudge them and educate them more about your product or services.

How? Simple. You can use two main ways to communicate with your buyers:

1. Email the merchant

2. Send payment links

You can also add a lead manually to manage it through the dashboard. You can export your leads in a CSV file to use it on other platforms as well.

When the buyer makes a purchase, he will automatically be tagged as a converted lead. You need not spend time filtering it out at your end.

At this point in the article, you must be wondering, have any businesses used Instamojo for our features? Well, yes, a few – 2 million to be precise! If you are looking for a payment gateway for startups, you can start here.