Great news! The RBI has introduced 24/7 round the clock RTGS transaction timings for customers and businesses! Effective today, The Reserve Bank of India (RBI) introduced the new rule to increase adoption of digital payments for all sectors.

What you should know about the new RTGS timings update:

- RTGS will now be available round the clock, 7 days a week. The old RTGS timings were 7:00 AM-6:00 PM during the week only!

- India is one of the few countries that offers 24 hours, 7 days a week, 365 days RTGS facility to its customers

- The main aim of the Government is to integrate global financial markets with increased online transactions and provide wider payment flexibility to companies

What is RTGS?

RTGS(Real Time Gross Settlement) is an online money transfer mode that allows you to transfer funds on a ‘real-time’ (immediate) basis. The main difference between NEFT and RTGS is – the money is settled in batches for NEFT, making it slower.

With RTGS, the money is credited in the beneficiary’s account in real-time. This fund transfer method is typically used to transfer huge amounts of money.

RTGS funds are credited instantly. The bank credits the funds within a 30-minute time frame.

Features of RTGS transactions that benefit SMEs

- RTGS is used for high-value transactions

- The minimum RTGS transaction amount is ₹2 lakh and there is no maximum limit! Side note: Some banks have an upper limit of over ₹ 10 lakhs, so make sure you are informed before making a payment

- With the RTGS, the beneficiary bank receives the instruction to transfer funds immediately when you carry out the transaction, and the transfer is instantaneous

- Every RTGS transaction is settled individually

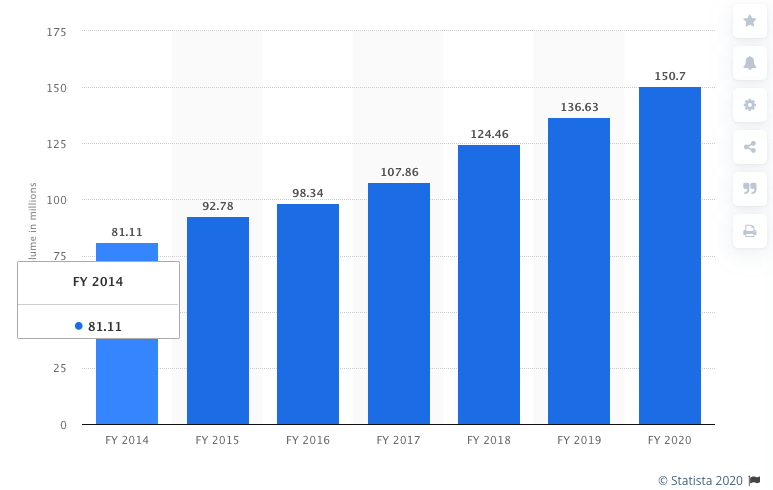

How online payments grew with NEFT and RTGS

In June 2019, RBI removed charges on NEFT and RTGS transactions for everyone. The RBI decided to do away with the minimum charges it levies on NEFT and RTGS transactions.

Previously, RBI levied minimum charges to banks on banks for any online NEFT and RTGS transactions routed through an online payment gateway. Since then, India has gathered over 150 million RTGS transactions in the fiscal year 2019.

Through this, banks levy a small charge on customers for every transaction. With the new rule, banks pass these benefits to its customers i.e small businesses.

What is the difference between NEFT and RTGS?

Feature | NEFT | RTGS |

Device of use | Phone and website | Phone and website |

Payout speed | 1-2 hours | About 30 minutes |

Timings | 24*7 operational | 24*7 operational |

Complexity | Requires IFSC, A/C no, and adding beneficiary | Requires IFSC, A/C no, and adding beneficiary |

Bank a/c details | Absolute must | Absolute must |

Charges (for sender) | Zero transaction charges | Zero transaction charges |

Transfer limit | No upper limit – Cash-based remittances limited to₹ 50,000 | No upper limit |

How MyPetrolPump uses Instamojo NEFT/RTGS for payments

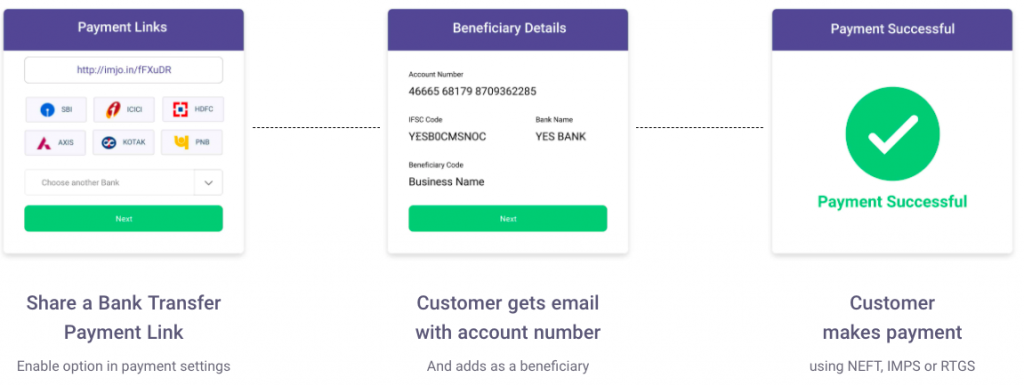

Instamojo has enabled NEFT/RTGS payment modes for small businesses, besides other modes of payment like digital wallets, UPI and Debit/Credit card (with no transaction fees!)

MyPetrolPump, an Instamojo user and successful startup uses the Instamojo NEFT – Virtual Account Number to track their online payments. With our NEFT/RTGS payments, you get –

- Multiple bank transfer flows

- Easy payment reconciliations

- Quick and easy settlements

- To track your payments and purpose of payment

- Payment facilities with Virtual Account Numbers

Instamojo facilitates NEFT and RTGS payments for all users. Earlier in December 2019, the Government enabled 24 hours NEFT transactions too! Also, you can use the Instamojo NEFT feature with payment links too. Watch the video below to know more.

COLLECT PAYMENTS ON INSTAMOJO USING NEFT/RTGS